Startup Activity Reaches New Heights

Illinois retains more startups than ever before

| Download Full Index | Startups Infographic | Tech Transfer Infographic |

|

|

|

Contents

- Introduction

- Key Findings

- University-Supported Startup Activity

- Illinois’ Growing Startup Resources

- Startups by Industry

- Startup Funding

- Direct University Funding to Entrepreneurs

- SBIR/STTR, I-Corps Funding

- Taking On the Gender Gap, Attracting International Entrepreneurs

- Supporting Community Small Business Growth

- Commercialization Output

- Alumni Entrepreneurship

- Looking Forward

Full Index methodology can be found here.

Introduction

Illinois’ universities have long been drivers of economic development and innovation, bolstering the state’s talent pipeline and conducting nearly $2.4 billion in academic research & development activity each year. Over the last decade, Illinois’ universities have also increased their efforts to ensure that innovations made possible by university research are able to reach the commercial marketplace. By doing so, universities drive direct economic impact through innovation and job creation.

In 2013, the Illinois Innovation Index began tracking technology commercialization and startup activity generated by Illinois’ universities. Spurred by an increase in resources and support—as well as better tracking of startups by universities—we’ve seen unprecedented growth in this activity over the past five years. Such support includes expanding entrepreneurship programs and facilities for students on university campuses; an increased emphasis on commercialization among research faculty; and expanded availability of capital for university-supported startups. This increased support has established Illinois’ universities as true incubators of new and promising ventures, and increased their ability to promote economic growth across the state.

Key findings:

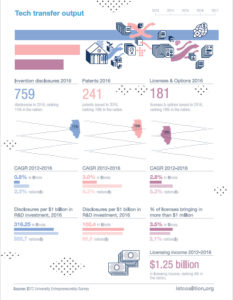

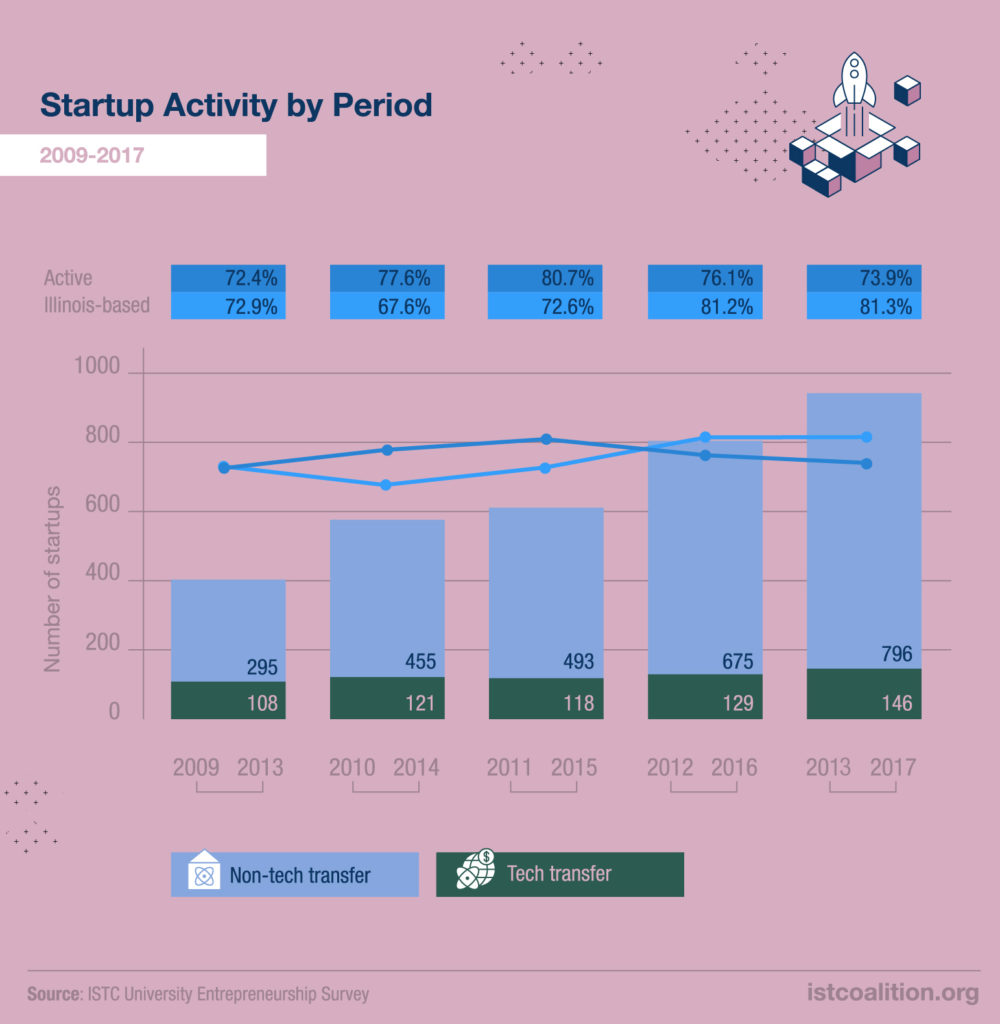

- Over the past five years (2012-13 to 2016-17), students and faculty at Illinois universities have founded 942 startups, the largest volume of startup activity since our survey began, and more than double the amount of the previous five year period (2009 to 2013).

- Nearly three-quarters (73.9 percent) of startups founded over the past five years remain active, while a quarter (25 percent) are inactive and 1.2 percent have been acquired.

- Among active startups founded over the past five years, 81.3 percent (566 startups) remain in Illinois, the highest level since we began collecting this data and a credit to the pipeline that has developed between universities and the state’s greater entrepreneurial ecosystem.

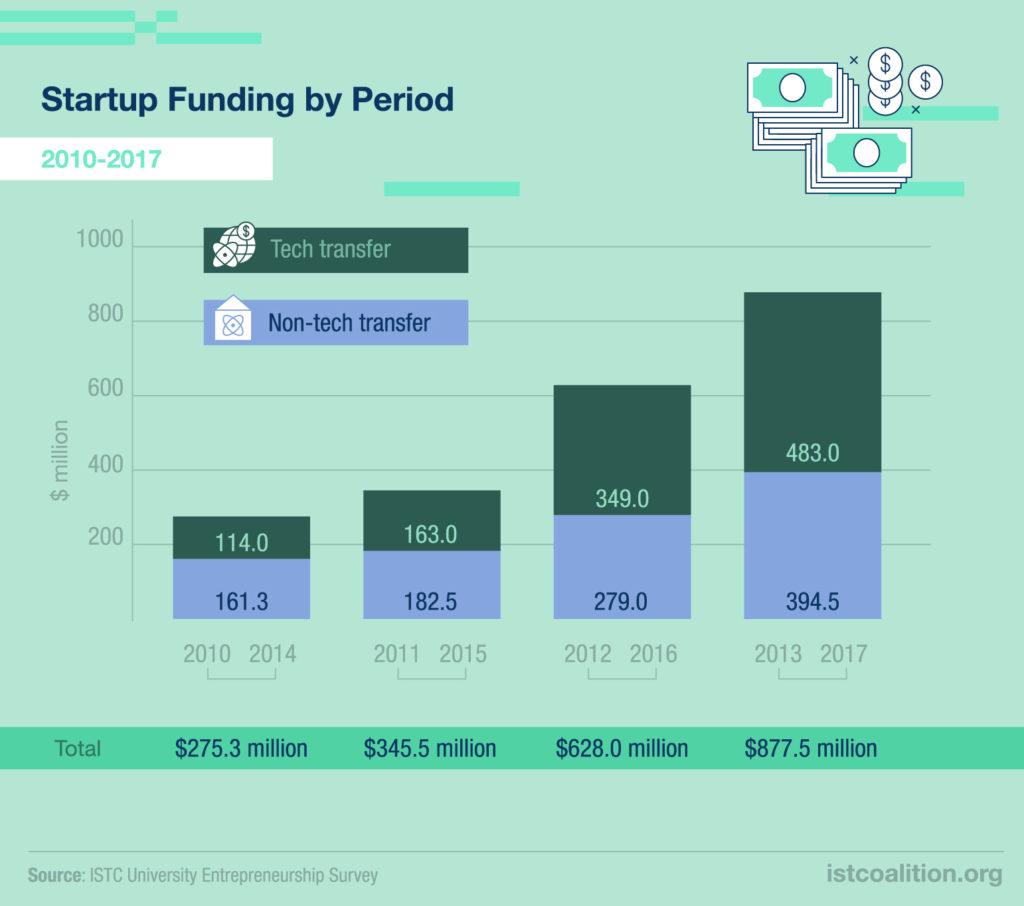

- Capital raised by university-supported startups also reached a new record in 2017, raising $877.5 million in outside funding over the past five years—more than tripling the total from 2010-14. While 8 in 10 startups receiving funding remain in Illinois, those receiving higher-level funding are more likely to leave the state.

- University-supported startups raised more than $40 million in funding from Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) over the past five years—a new record for the state. Startups receiving SBIR/STTR funding are more likely to remain active and more likely to stay in Illinois.

- More than 100 university-supported startups have participated in the National Science Foundation’s (NSF) I-Corps program over the past five years. Startups participating in the I-Corps program are more likely to remain active, more likely to remain in Illinois, and 3.5 times more likely to receive SBIR/STTR funding.

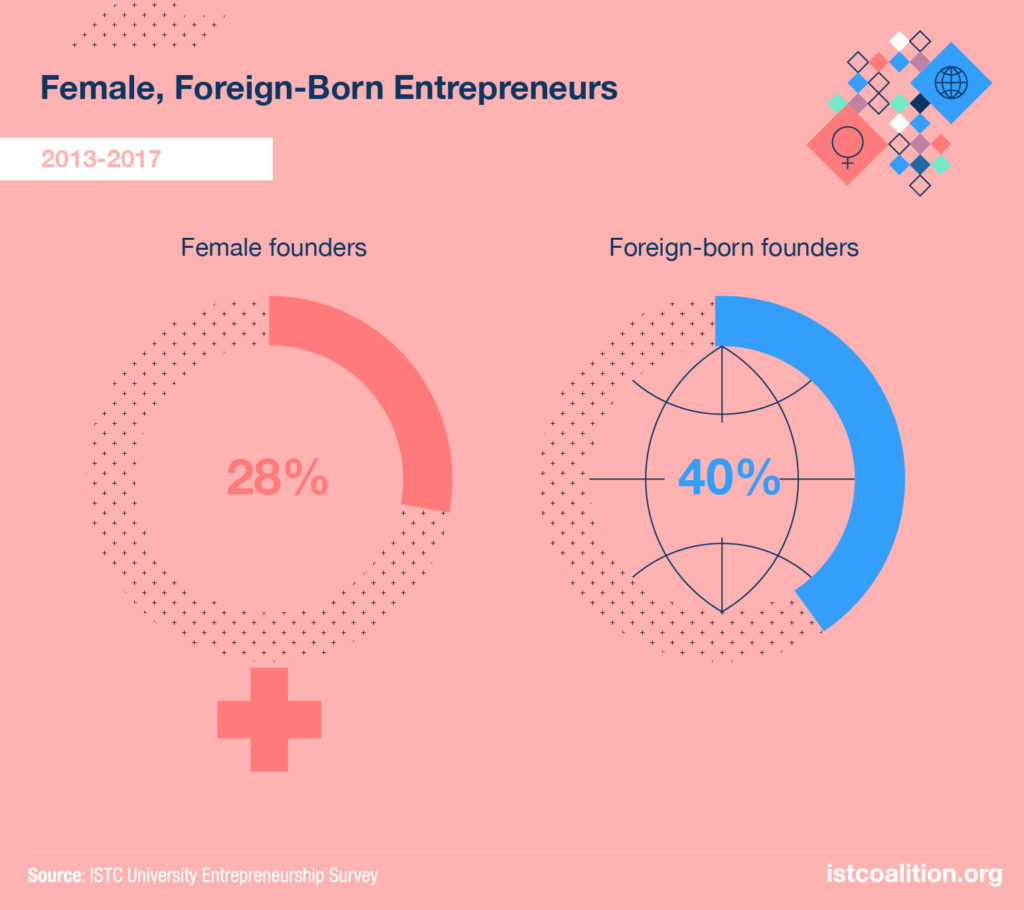

- Universities are stepping up efforts to increase the share of female and underrepresented groups in entrepreneurship. Compared with the national average, startups spun out of Illinois’ universities are more likely to be founded by women—28 percent of university-supported startups have a female founder, compared with 17 percent nationally.

- Based on available data, an estimated 4 in 10 university-supported startups have a foreign-born founder. This finding is consistent with nationwide trends, where immigrants pull above their weight in entrepreneurship. To ensure foreign-born entrepreneurs are able to stay in the US to grow their businesses and create jobs, immigration reforms like the International Entrepreneur Rule should be embraced.

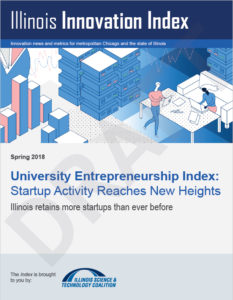

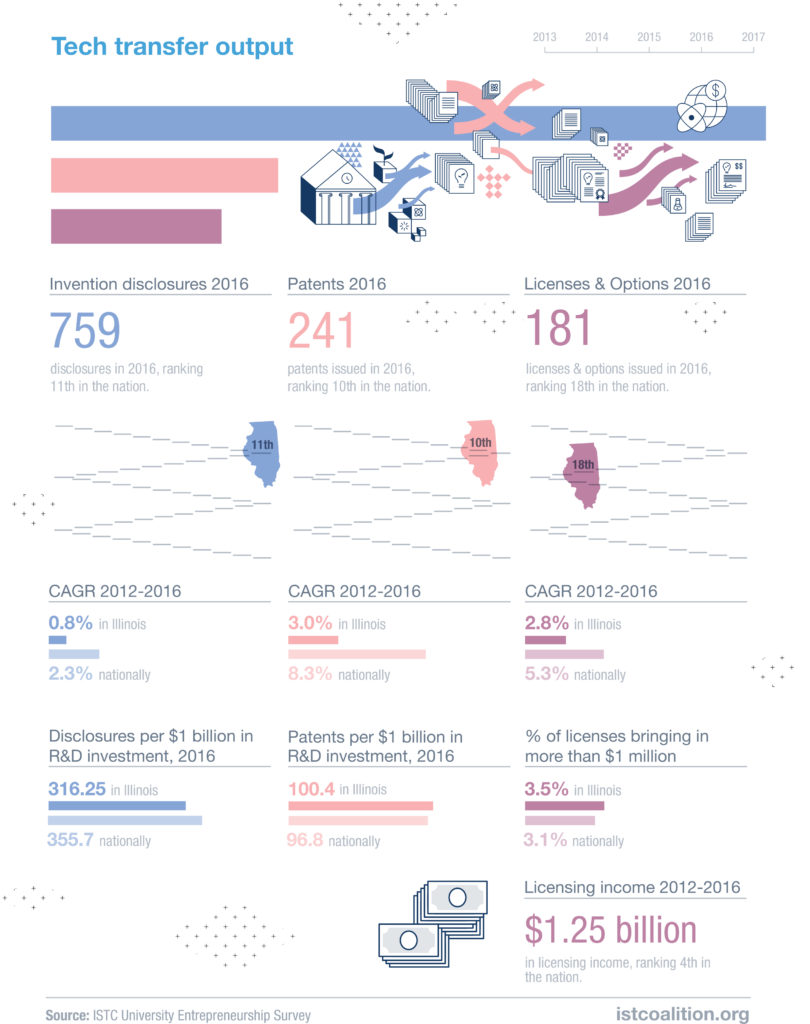

- Beyond startup creation, Illinois’ universities remain an engine of innovation. In 2016, Illinois’ universities disclosed 759 new inventions and were awarded 241 patents—both new records for the state. Universities in the state also created 181 licenses, generating $287 million in revenue, an increase over 2015 figures. However, despite reaching new highs in 2016, growth in many tech transfer metrics lags the national average.

University-Supported Startup Activity Continues to Rise

Over the past five years, students and faculty of Illinois’ universities have founded 942 startups with the support of university technology licensing, entrepreneurship programs and competitions, and other university initiatives.[1] This volume of startup activity is the largest since our entrepreneurship survey began, when just over 400 startups were spun out of the state’s universities from 2009 to 2013.

Much of the growth in startup activity at universities can be attributed to the growth of non-tech transfer startups—companies that do not license university technology. These startups are often founded by students through on-campus entrepreneurship centers. Nearly 800 non-tech transfer startups were founded with support from Illinois universities from 2013 to 2017, growing 28 percent annually since 2013.

Tech-transfer startups—those created to commercialize university intellectual property (IP)—are also at an all-time high. Between 2013 and 2017, 146 tech-transfer startups were spun-out of Illinois universities, compared with 108 from 2009 to 2013.

Of startups founded from 2013 to 2017, 73.9 percent (696 startups) remain active, while 25.0 percent (235) are inactive and 1.2 percent (11) have been acquired. The share of startups remaining active has fallen since its peak from 2011 to 2015, when 80.7 percent of startups were still active. However, the share of active startups remaining in Illinois reached a new high in 2017, with 81.3 percent of startups remaining in the state (566 startups)—up from 72.9 percent when our survey began in 2013. The share of startups remaining in Illinois is a credit to the pipeline that has developed between universities and the resources provided by the state’s larger entrepreneurship ecosystem.

Illinois’ Growing Startup Resources

Over the past decade, universities in Illinois have created and grown their own vibrant startup ecosystems. These ecosystems are anchored by university-managed incubators and entrepreneurial hubs—including Bradley University’s Peoria NEXT Innovation Center, Illinois State University’s Means Center, Illinois Tech’s UTP Incubator, Northern Illinois University’s Eiger Lab, Northwestern’s Garage, Southern Illinois University’s Research Park and Small Business Development Center, University of Chicago’s Polsky Center, University of Illinois at Chicago’s Office of Technology Management, University of Illinois Springfield iSPI incubator, and University of Illinois at Urbana-Champaign’s EnterpriseWorks incubator. In addition, the new Illinois University Incubator Network (IUIN) supports incubators and entrepreneurial ecosystems associated with higher education across Illinois. The communities of entrepreneurship built around these university resources have been pivotal to the growth of startup activity in Illinois.

More than ever before, university-supported startups in Illinois are also able to connect directly with an ecosystem of incubators, accelerators, capital, and talent once they leave campus. This includes Illinois’ network of organizations and initiatives dedicated to supporting and funding entrepreneurs. Growing resources include 1871, BLUE1647, Built in Chicago, Catapult Chicago, ChicagoNEXT, Future Founders, ICNC, Illinois Technology Association, mHUB, TechNexus, Techstars, UI LABS, and many more. Industry-specific resources include 2112, CBC Accelerator Network (CBCAN), Chicago Innovation Mentors, Clean Energy Trust, Current, Energy Foundry, iBIO Institute, MATTER, and The Hatchery. The developing pipeline between universities and these entrepreneurial resources helps ensure consistent support for startups once they leave campus, while also improving startup retention in Illinois.

Company Spotlight: Prisma

Prisma is an e-commerce technology startup founded by students from Illinois State University (ISU) in Normal, Illinois. With coaching and financial support from the George R. and Martha Means Center for Entrepreneurial Studies at ISU, the Prisma team has researched and developed their XSPACE product. XSPACE allows retailers to generate 2D pictures, 360-degree product views, and 3D models for online sales at 25% of current costs. The XSPACE platform also reduces the overhead associated with managing an online store. Recently Prisma entered its first round of funding, allowing it to develop the web app beta, upgrade robotics, and file for a patent.

University of Chicago, University of Illinois at Urbana-Champaign Partnering to Expand Entrepreneurship

The University of Chicago and the University of Illinois at Urbana-Champaign are launching a partnership dedicated to research, technology development, and commercialization. The partnership will bring about 100 faculty, researchers and students from Urbana-Champaign to collaborate with University of Chicago colleagues, entrepreneurs, and industry leaders. The new collaboration will be part of the expansion of the Polsky Center at a proposed new Hyde Park innovation facility. The primary goal of the partnership will be to develop and commercialize groundbreaking technology—taking on challenges from clean water to treating cancer—and creating successful ventures along the way. Such collaboration between two of the state’s top universities isn’t new—startups such as ExplORer Surgical and Tovala have utilized resources and talent from both universities in order to build and launch their ventures.

Company Spotlight: Amper

Founded by Northwestern University undergraduates in 2016, Amper Technologies is a startup that helps manufacturers improve machine and labor productivity by monitoring key metrics of their machines in real-time. Amper started as a project at a hackathon and grew as they utilized resources at Northwestern, including The Garage Residency Program, NUvention: Energy coursework, and funding from NUSeeds—as well as the MIT Clean Energy Prize and The Thiel Foundation. After graduation, Amper spent time at the HAX hardware accelerator in Shenzhen, China, and Alchemist Accelerator in San Francisco. With support from these programs, Amper was able to validate their value proposition and technology by having several successful customer case studies. Following Amper’s time in San Francisco, the company closed its seed funding round and moved to its current location at Chicago’s mHUB makerspace.

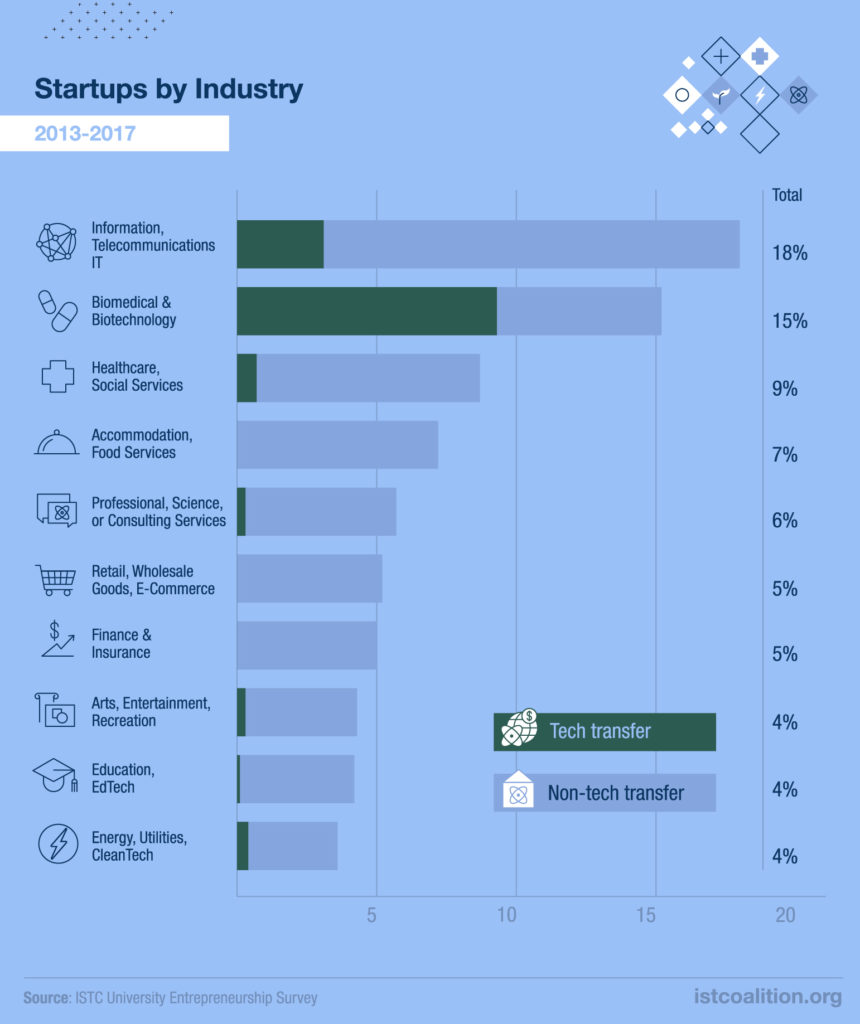

Startups Cover a Variety of Industries, IT and Health Most Prominent

Illinois’ university-supported startups are tackling challenges in a wide range of industries, from therapeutics battling cancer; to novel Internet of Things sensors for crop monitoring; to undersea WiFi for the military and oil and gas industry. Health-related startups—those in biomedical & biotechnology (15.2 percent) and healthcare and social services (8.7 percent)—account for nearly a quarter of all startups. Information, communications, and IT startups accounted for 18 percent of all startups founded over the last five years.

Tech transfer startups are more concentrated in health and IT, with health-related startups (57.6 percent) and information, communications, and IT startups (17.8 percent) making up more than three-quarters of all startups. Non tech transfer startups are more widely dispersed among industries—with health-related, IT, food, professional services, and retail each accounting for more than 5 percent on non tech transfer startups.

Startup Funding Reaches Record High

As the number of startups spun-out of universities has risen in recent years, so too has the funding those startups have raised. From 2013 to 2017, Illinois university-supported startups raised $877.5 million. This figure has more than tripled since university-supported startups in the state raised $275.3 million from 2010 to 2014.

Funding raised by startups continues to be more highly concentrated among tech transfer startups, which raised an average of $6.2 million, compared with $1.5 million for non tech transfer startups.[2] Biomedical and biotechnology startups raised the most funding by far, with companies founded between 2013-2017 bringing in $386.9 million from outside investors. The vast majority of funding in the field went to tech transfer startups, which often commercialize new therapies developed at one of the state’s university research centers. In fact, four of the top five startups in terms of investment are biomedical or biotechnology, tech transfer startups.

Despite the impressive growth of capital raised by university startups, funding challenges still exist for university-supported startups in Illinois. Though nearly 8 in 10 startups that receive funding remain in Illinois, startups that have raised more than $5 million in funding are significantly more likely to be located outside the state (61.8 percent). This finding suggests that early-stage funding is available to companies in Illinois, but startups are more likely to leave the state in pursuit of higher-level funding. To keep these high-growth, job creating startups in Illinois, the community should look to increase access to higher-level funding—which can be difficult to source outside of the coasts.

One effort that is helping to improve access to capital is the Illinois Treasurer’s Illinois Growth and Innovation Fund (ILGIF), which was established to attract, assist, and retain quality technology businesses in Illinois. Established in 2016, ILGIF has committed over $220 million to invest in technology funds with a minimum size of $10 million. ILGIF’s investments aim to deliver strong investment performance for Illinois, while also driving economic development through capital investment in the state’s growing technology companies.

Company Spotlight: ClostraBio

Life-threatening allergic responses to food are an increasingly important public health problem. It is estimated that two children in every classroom now have a food allergy that requires strict dietary avoidance. Children with allergies often deal with reduced quality of life from the fear that an accidental exposure will trigger a life-threatening anaphylactic response. Food allergies are also closely linked to other diseases such as eczema, asthma, and allergic rhinitis. ClostraBio was founded in 2016 by University of Chicago professors Cathryn Nagler and Jeffrey Hubbell. The company aims to develop drugs that will enable patients living with food allergies to eat without fear of an allergic reaction by harnessing protective bacteria and the substances they produce in the complex microbiome of the gut. To translate their research into a promising new venture, Nagler and Hubbell made use of a variety of programs and resources offered by the University of Chicago’s Polsky Center for Entrepreneurship and Innovation; including NSF’s I-Corps program, as well as Polsky’s Innovation Fund and New Venture Challenge. With support from these resources, ClostaBio closed its $3.5 million seed round, allowing the company to continuing testing and bring its research closer to market.

University Funds Provide Direct Support to Entrepreneurs

Over the past several years, universities have stepped up efforts to provide financial support to their startups. This includes the creation of proof-of-concept (POC) and innovation funds that provide startups with critical early-stage capital. Formed in 2002 to catalyze the creation and development of research-derived companies from the University of Illinois, IllinoisVENTURES supports startups by providing POC funding as well as seed and venture capital. In 2018, IllinoisVENTURES—which also manages the University of Illinois at Chicago’s Chancellor’s Innovation Fund—raised an additional $15 million for its Illinois Emerging Technologies Fund, which provides larger venture capital funding to help early-stage companies grow beyond the startup level. IllinoisVENTURES portfolio companies have raised an additional $1.3 billion in outside funding, a 25:1 leverage.

The University of Chicago’s Innovation Fund provides POC and early-business development funding. In addition, the University of Chicago has designated $25 million of its endowment to invest in startups through the university’s UChicago Startup Investment Program. Chicago Booth Executive Program students and the Polsky Center for Entrepreneurship and Innovation also collaborated to start the angel investment group Hyde Park Angels. Since its inception in 2006, Hyde Park Angels has invested more than $35 million in nearly 140 deals.

Northwestern University has also established two funds to accelerate the growth of university startups. The $10 million N.XT Fund supports the commercialization of research-driven technologies, while the $4 million NUseeds Fund supports early-stage student-founded startups. The university’s Investment Office also provides additional higher-level follow-on funding to Northwestern startups.

Company Spotlight: Amber Agriculture

Amber Agriculture is a startup developing IoT wireless sensing and automation solutions to help farmers monitor their crops. Amber was co-founded by University of Illinois at Urbana-Champaign (UIUC) students Joey Varikooty and Lucas Frye in 2015. The founders met at 54.io, a three-day hackathon meant to help create and guide startup teams. Varikooty, an undergraduate engineering student was developing a wireless sensor to monitor moisture levels. Frye, an MBA student with an undergraduate degree in agriculture saw the potential application for grain storage, and Amber Agriculture was born. Following 54.io, the Amber team participated in the Founder’s Startup Bootcamp, before winning grand prize at the Cozad New Venture Competition. To further develop their technology and conduct market research, Amber also participated in NSF’s I-Corps program, the iVenture Accelerator, and received funding from IllinoisVENTURES. In 2017, Amber was named the top startup at the Consumer Electronics Show (CES), the world’s largest consumer electronics and technology tradeshow.

SBIR/STTR Funding, I-Corps Valuable Tools for Startup Growth

The federal government is playing a significant role in catalyzing startup growth through a number of key funding initiatives. The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) are offered by a number of federal agencies to encourage small businesses to engage in research and development that has the potential for commercialization. SBIR/STTR funding can be vital as startups move from the proof of concept stage toward commercialization. Overall, Illinois ranked 13th in both the number of companies receiving awards (545), and award amount ($216.6M) from 2013 to 2017.[3] Despite making up 3.9 percent of the nation’s population, Illinois received just 2.2 percent of total SBIR/STTR funding over that period.

University-supported companies founded from 2013 to 2017 have raised $40.6 million in SBIR/STTR funding, up from $32 million from 2012 to 2016. Receiving SBIR/STTR funding boosts the viability of young companies and creates a tether to the region. Compared with all university-supported startups, those that receive SBIR/STTR funding are more likely to remain active (92.4 percent) and to remain in Illinois (87.9 percent).

The National Science Foundation’s I-Corps program was developed to prepare researchers to extend their focus beyond the university setting and move their discoveries toward commercialization. Adding to the impact of I-Corps is the program’s Midwest Node (MWIN), which aims to spur innovation, collaboration, and economic impact in the region. The Midwest Node brings together the expertise of the University of Michigan, University of Illinois Urbana-Champaign, Purdue University and the University of Toledo. It forms the backbone for a network that educates, supports, and connects academic researchers to the entrepreneurial ecosystem across the region.Over the past five years, 102 university-supported startups participated in the I-Corps program.

As with SBIR/STTR funding, I-Corps participant startups are more likely to remain active (81.4 percent) and more likely to remain in Illinois (91.6 percent). Companies participating in I-Corps are 3.5 times more likely to receive SBIR/STTR funding, offering a clear path to improving the share of this funding awarded to Illinois companies.

Universities Taking On the Gender Gap, Attracting International Entrepreneurs

Diversity in entrepreneurship—including an underrepresentation of female founders—remains an obstacle to inclusive economic growth. A recent analysis from Crunchbase shows 17 percent of funded startups had at least one female founder in 2017, up from 9 percent in 2009.[4]

To take on this challenge, universities across Illinois are taking steps to improve the share of currently underrepresented groups in entrepreneurship. The University of Illinois at Urbana-Champaign’s AWARE program offers a dedicated entrepreneur-in-residence, mentorship, proof-of-concept grants, and events to underrepresented entrepreneurs. Northwestern University’s INVOReach also provides resources for underrepresented entrepreneurs, including events and resources to test and explore business propositions. At the University of Chicago’s Polsky Exchange, monthly female founder meetups help founders connect to and support one another. The Polsky Center also hosted a National Science Foundation-supported conference to empower female STEM researchers on how to apply innovation to their work in Fall 2017.

Efforts to promote women in entrepreneurship appear to be paying off. Over the past five years, 28 percent of university-supported startups in Illinois had at least one female founder[5] —significantly higher than the nationwide figure of 17 percent. In addition, Northwestern University and the University of Illinois Urbana-Champaign are both ranked in the top 20 for female undergraduate alumni entrepreneurship. At the MBA level, Northwestern’s Kellogg and the University of Chicago’s Booth business schools are in the top 10 nationally for female alumni entrepreneurship.[6]

The strength of Illinois’ universities attract talent from around the world. International and immigrant students account for 35.1 percent of non-health STEM degrees and a staggering 49.9 percent of all computer science degrees awarded in the state. To the benefit of the state, much of this international talent is staying after graduation to pursue entrepreneurship. Over the past five years, an estimated 40 percent of university-supported startups have had at least one foreign-born founder.[7] This finding is consistent with nationwide trends in entrepreneurship. Nationwide, one-third of venture-backed startups—and more than half of startups valued over $1 billion—have been founded by immigrants.

The ability of Illinois’ universities to attract international talent, especially in STEM fields, represents tremendous potential for economic growth for the state. To capitalize on that economic potential, immigration reforms such as the International Entrepreneur Rule (or IER, commonly referred to as the “Startup Visa”) should be embraced. The rule allows foreign-born entrepreneurs who meet certain criteria to remain in the US while growing their startup and creating jobs. Recent analysis shows that full implementation of IER would create between 135,000 and 308,000 American jobs over the next decade.[8]

Illinois Universities Supporting Community Small Business Growth

In addition to supporting student and faculty ventures, the University of Chicago, Northwestern University, and the University of Illinois are stepping up to support entrepreneurship in their communities. As part of this effort, the University of Chicago and Northwestern University are participating in Ascend 2020, an initiative that partners with top universities and institutions to provide business assistance and opportunities for minority-owned, women-owned, and veteran-owned businesses in major metropolitan areas.

With support from Ascend 2020, the University of Chicago’s Polsky Small Business Growth Program focuses on small businesses located on the South and West Sides of Chicago. Small teams of highly-skilled University of Chicago students provide hands-on consulting experience to companies, helping them address key business challenges and determine new strategies for business growth. The Polsky Center is also working with outside partner organizations such as Accion, LISC, CASE, and the Chicago Urban League to find ways to provide additional financing, coaching, and other wrap-around services for these consulting engagements.

Northwestern University’s Kellogg School of Management is also partnering with Ascend 2020 to offer ASCEND@Kellogg, a four-day residential management education program focused on entrepreneurial growth. The program engages a cohort of minority-owned and other businesses that have a significant percentage of employees from Chicago’s under-resourced neighborhoods. This partnership between Kellogg and Ascend 2020 aligns management education, market access, and capital access to grow businesses and jobs in low and moderate income (LMI) communities in Chicagoland, and to develop a network that links business schools, market access organizations, and financial institutions.

In 2017, the University of Illinois EnterpriseWorks incubator was awarded two U.S. Economic Development Administration awards totaling over $800,000 to aid entrepreneurship in Illinois. The University of Illinois EDA University Center program fosters entrepreneurship in Illinois south of Interstate-80 with direct small business assistance led by University of Illinois students. In addition, the Economic Adjustment Assistance Grant supports the new Illinois University Incubator Network (IUIN) to advance incubators and entrepreneurial ecosystems associated with higher education across Illinois. EnterpriseWorks also provides entrepreneurial spaces located across Illinois, including many in economically distressed counties.

Company Spotlight: OceanComm

OceanComm is a University of Illinois at Urbana-Champaign (UIUC) startup commercializing the first video-capable wireless underwater modem. Founded by electrical and computer engineering faculty member Andrew Singer and alumnus Thomas Riedl, OceanComm’s technology uses ultrasound to send information wirelessly underwater. At around 1,000 times faster than existing underwater wireless communication, OceanComm’s technology eliminates the need for expensive communication support ships and creates the potential for untethered robotic divers (ROVs). To help develop their technology, OceanComm has received support from UIUC’s Cozad New Venture Challenge, participated in NSF’s I-Corps program, and received SBIR funding. OceanComm is headquartered at UIUC’s Research Park and utilizes the mHUB makerspace in Chicago.

Illinois Universities Increase Commercialization Output

Technology transfer (tech transfer) is the process through which university research, discoveries and inventions become commercially available. The process typically involves three key steps: the disclosure of a new technology made possible through university research, the protection of the technology through patents or copyrights, and the eventual commercialization of the technology through licenses or options.

In 2016, Illinois universities disclosed 759 inventions and were awarded 241 patents, both new records for the state.[9] Universities in the state also created 181 licenses, generating $287 million in revenue, an increase over 2015 figures. Over the past five years, Illinois universities have brought in $1.25 billion in licensing income, ranking fourth in the nation. The University of Illinois system also consistently ranks among the leaders nationally in tech transfer. In 2016, the university ranked 12th in invention disclosures, 14th in patents, and 21st in licenses and options nationally. However, despite reaching new highs in 2016, growth in many tech transfer metrics lags the national average.

Company Spotlight: Actuate Therapeutics

Actuate Therapeutics, Inc. is a private biopharmaceutical company focused on the development of compounds for use in the treatment of cancer, and inflammatory diseases leading to fibrosis and neurodegeneration. Actuate was founded in 2015 with a mission of discovering, developing, and commercializing new agents based on intellectual capital developed in the laboratories of Dr. Alan Kozikowski at the University of Illinois-Chicago and the Center for Developmental Therapeutics at Northwestern University. The company is led by a senior management and scientific team with decades of pharmaceutical industry experience leading successful discovery, development, and commercialization of new therapeutic agents and health related technologies. Actuate is currently advancing its lead molecule, which competitive analysis has shown to be best in class. Ongoing research has demonstrated significant anti-tumor activity in many difficult to treat cancers, including cancers of the brain, pancreas, lung, and breast. Actuate closed its series A funding round of $3.8 million in June 2017—which included investment from IllinoisVENTURES—and will begin clinical trials in 2018.

Illinois Universities Among the Most Prolific Producers of Alumni Entrepreneurs

In recent years, universities across the state have increased resources for students who choose to pursue entrepreneurship while on campus. However, many entrepreneurs start their ventures after graduation. To assist these entrepreneurs, Illinois universities are making more of their resources available to alumni. This includes welcoming alumni to on-campus entrepreneurship programs, providing online curriculum, connecting potential entrepreneurs with active startups, holding workshops, and establishing alumni entrepreneurship groups.

Northwestern University, the University of Chicago, and the University of Illinois at Urbana-Champaign (UIUC) are among the nation’s most prolific producers of alumni entrepreneurs. Over the past decade, undergraduate alumni from UIUC and Northwestern have collectively founded nearly 750 venture-backed companies, raising over $11 billion in funding.[6] Northwestern’s Kellogg School of Management and the University of Chicago’s Booth School of Business are also both ranked in the top 10 for MBA alumni founders. Collectively, Kellogg and Booth MBA alumni have founded nearly 800 companies, raising an additional $11 billion in funding.

Company Spotlight: Great Lakes Neuroscience

Great Lakes Neuroscience (GLN) is a drug discovery company aimed at developing a treatment for rare diseases such as Progressive Multiple Sclerosis and Amyotrophic Lateral Sclerosis or ALS, which collectively affect more than 75,000 people in the US. Founded by students from MBA and PhD programs at Illinois Institute of Technology (IIT), GLN was a finalist in the Neuro Start-up Challenge in 2015, a competition sponsored by the National Institutes of Health in collaboration with the Center for Advancing Innovation. After executing an exclusive license agreement with the National Institutes of Health to commercialize a treatment for ALS, MS and 13 other related diseases, GLN went on to raise a round of angel investment for pre-clinical stage in-vivo animal studies. Along the way, GLN has relied on the invaluable assistance of various institutes, both on and off IIT campus including the IIT Knapp Entrepreneurship Center, Chicago-Kent Patent Hub, University Technology Park at IIT, Neal Gerber Eisenberg LLP., iBio PROPEL, Chicago Innovation Mentors, and Chicago’s MATTER incubator.

Look Forward

By increasing support for commercialization and entrepreneurship, Illinois’ universities have expanded their role as drivers of economic growth in the state. As a result, university-supported startup activity flourished from 2013 to 2017—more than doubling the activity of the previous five year period. The past five years also saw more external funding for startups—and crucially, more startups remaining in Illinois—than ever before. To take full advantage of university commercialization and entrepreneurship efforts, stakeholders across the state should look to further develop the pipeline between campus resources and Illinois’ larger entrepreneurship ecosystem. Illinois should also expand strategies to increase access to higher-level startup funding in-state. Finally, universities and the state’s greater entrepreneurship ecosystem should strive to further promote diversity and inclusiveness among underrepresented groups in entrepreneurship. Taking these steps would help ensure that startups catalyzed by Illinois’ universities are able to thrive in the state.

Archive

2018 - University Entrepreneurship Index

Illinois Retains More Startups Than Ever Before

2017 - University Entrepreneurship Index

Illinois university startups surge to record level

2016 - University Entrepreneurship Index

A detailed look at university startup creation, tech transfer, and local funding trends

2015 - University Entrepreneurship Index

Illinois universities spur innovation through technology transfer and entrepreneurship

2014 - University Entrepreneurship Index

Dynamism in Illinois: Tracking technology development at universities and research institutions from inception to commercialization