R&D Index: Illinois’ R&D landscape and path forward

New analysis finds slow R&D growth in Illinois, despite key academic and business areas of strength.

Download the full 2017 R&D Index.

The importance of research and development

Research and development (R&D) is the lifeblood of innovation. Universities, corporations, state and federal agencies, laboratories, and nonprofits all utilize R&D to advance scientific discovery and generate innovation that creates jobs and improves quality of life. This issue of the Index comes at a pivotal moment for R&D in the United States. Although the positive return on investment (ROI) for R&D is well understood,[1] funding for R&D is currently under threat —both nationally and in Illinois. President Trump’s 2018 budget proposal would cut many of the agencies that invest in R&D, significantly scaling back the critical role the federal government plays in innovation. Given the large scale and long timeframe of R&D, such cuts have the potential to set innovation back decades. On the state level, Illinois’ budget impasse has limited direct funding to public universities since 2015, creating a climate of uncertainty that hinders the ability of state universities to attract R&D investment from federal agencies and private foundations. Also, though Illinois’ business R&D tax credit was reinstated in July of 2017, the state has allowed it to sunset four times in the past 14 years, limiting the state’s competitiveness compared with many of its peer states.[2]

To understand Illinois’ place in the national R&D landscape, we benchmark the state’s performance against peer states, highlighting areas of strength and opportunities for growth.[3] Our analysis uses several measurements to capture the inputs and outputs of R&D in the state. To capture the inputs of R&D, our analysis focuses on expenditures, which provide the most direct measurement of volume in the state. The outputs of R&D can be more difficult to quantify. In this analysis, we use both patents and academic articles as proxy measurements for the innovation output of R&D. Together these measurements provide insight into R&D at Illinois’ universities, within the business community, and at the state’s federal labs while also presenting an overview of the state’s growth relative to peer states across the country.

Key findings

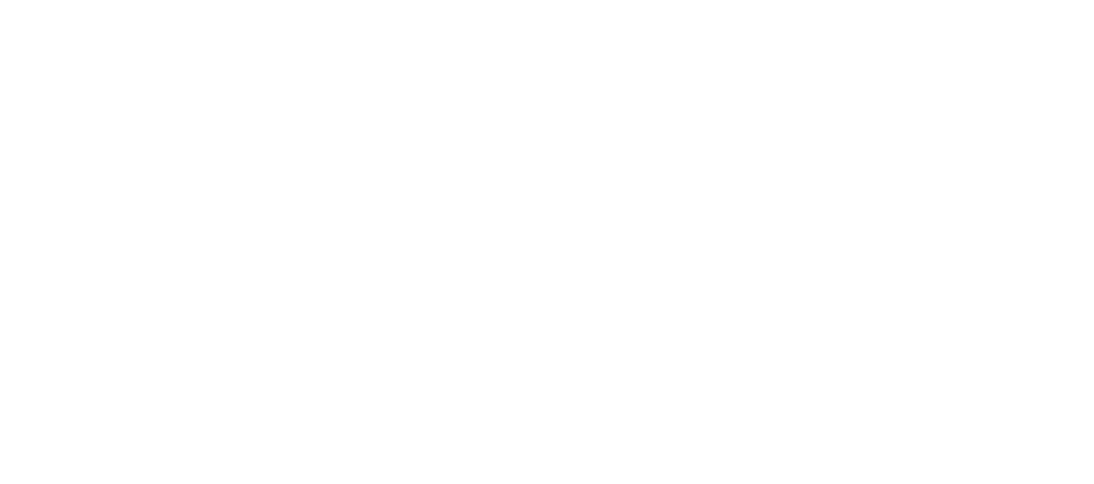

- Illinois is one of the most active states for R&D in the nation, ranking eighth in overall R&D, academic R&D, and business R&D. However, despite the state’s high volume of activity, the R&D landscape in Illinois has grown less quickly than in many of its peer states.

- Overall R&D in Illinois grew by just 0.2 percent from 2010 to 2014, compared with 4.0 percent growth nationally. This lack of growth was due in large part to the relative stagnation of business R&D in the state, which grew by just 0.3 percent annually during that period, compared with 5.1 percent annual business R&D growth nationally.

- Illinois’ strongest academic disciplines for R&D match many of the state’s top business industries, including agriculture, medical sciences, and chemistry. Academic research in computer science is also a strength in Illinois. This is consistent with the state’s production of computer science talent, where Illinois is a national leader.

- Illinois is the sixth largest producer of science, health, and engineering academic articles nationally. Academic research funding yields a high rate of return in Illinois, with the state producing more academic articles per $1 million in funding, compared with the national average.

- Illinois’ two national labs, Argonne and Fermilab, boost the state’s R&D activity by more than $1 billion annually while also contributing critical resources to, and collaborating with, the business and academic R&D communities.

- Despite slow growth for business R&D compared to peer states, activity in pharmaceuticals, machine manufacturing, insurance, and food remain significant strengths for Illinois’ business sector R&D landscape.

- Illinois ranks seventh nationally in patent production, with more than 5,000 patents awarded each year. Several of the nation’s largest patent holders are also headquartered in Illinois, including Boeing, Caterpillar, Deere & Company, Illinois Tool Works, and Motorola Solutions.

- Cross-sector R&D collaborations are key drivers of innovation in Illinois. These collaborations include partnerships among universities, industry, and Illinois’ national labs, each of which provide unique perspectives and resources to the R&D process.

- Essential funding for R&D, both in Illinois and nationally, is currently under threat. At the federal level, President Trump’s proposed 2018 budget would make drastic cuts to agencies that fund vital R&D activity, including the DOE, the NIH, and the NSF. In Illinois, a lack of stable state funding in recent years has created an atmosphere of uncertainty that threatens R&D growth.

- Moving forward, the state must ensure stable funding to its public universities, thus improving their ability to attract research talent and investment. Illinois should also make permanent its business R&D tax credit, which has sunset four times in the past 14 years, limiting competitiveness compared with many peer states.

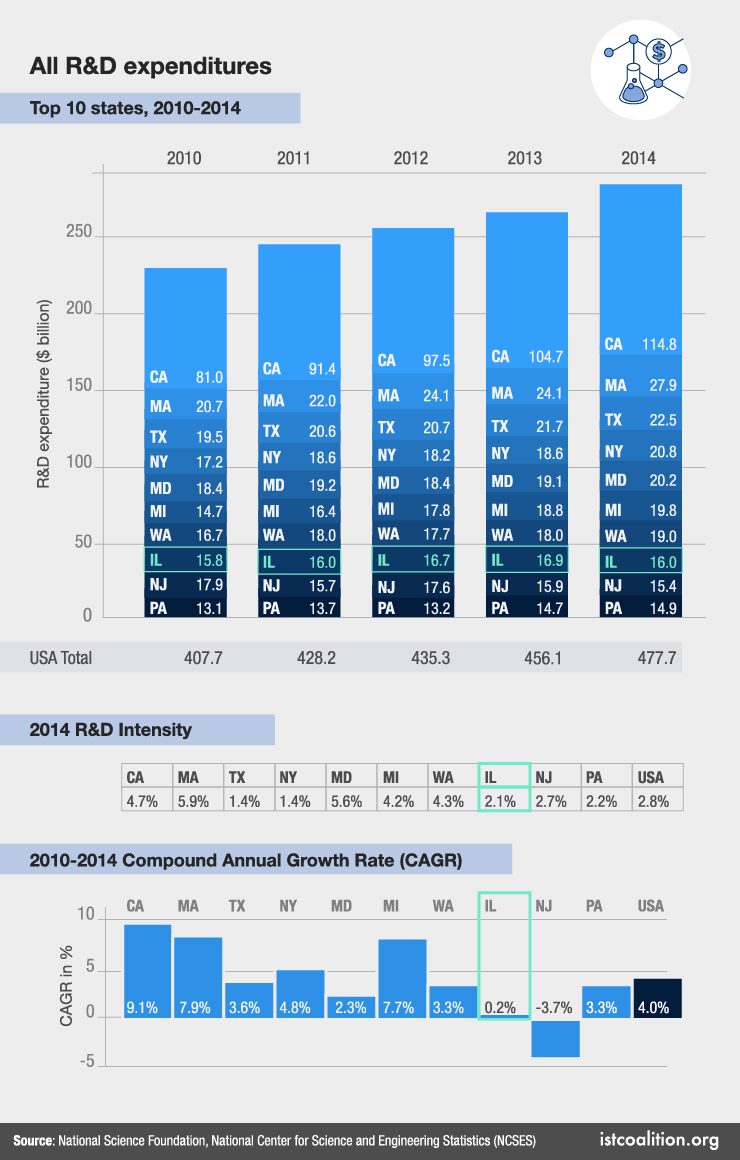

Overall R&D expenditures stagnate in Illinois

Illinois is an R&D engine for both the Midwest and the nation, ranking eighth nationally in overall R&D expenditures. Despite the large amount of R&D conducted in Illinois, the state’s R&D activity is not growing as quickly as many of its peer states. Total R&D expenditures grew by just 0.2 percent annually from 2010 to 2014, compared with 4.0 percent annual growth nationally. This relative stagnation of R&D in Illinois is due in large part to the slow growth of business R&D, which makes up more than three-quarters of all R&D conducted in the state. From 2010 to 2014, business R&D in Illinois grew by just 0.3 percent annually, compared with 5.1 percent annual growth nationally. Illinois also lags the national average for overall R&D intensity, a measure of all R&D expenditures as a percentage of total gross domestic product (GDP). Despite being the fifth largest state by GDP, Illinois ranks 25th nationally in R&D intensity, spending 2.1 percent of state GDP on R&D compared with 2.8 percent nationally.

SPOTLIGHT: The International Institute for Nanotechnology

The International Institute for Nanotechnology (IIN) was founded in 2000 by Northwestern University as a first-of-its-kind hub for nanotechnology research. IIN is a collaborative effort among a deep talent pool of chemists, engineers, biologists, physicians, and business experts jointly focused on solving societal challenges. The institute has created partnerships with universities in 18 countries, more than a dozen federal agencies, and more than 100 corporations, including Illinois industry leaders like Abbott, Baxter, Caterpillar, and Motorola. Thus far, IIN has supported more than $1 billion in nanotechnology research, educational programs, and supporting infrastructure. This support has resulted in extensive economic impact, including more than 1,800 commercialized innovations and more than $700 million in venture capital funding.[4]

Both in Illinois and nationally, most R&D is performed by businesses and higher education institutions. In Illinois, R&D performed by higher education institutions makes up a greater share of all R&D than in peer states, while the share of business R&D is on par with peer states. Thanks to R&D conducted at Argonne and Fermilab, the proportion of R&D performed by federally funded research and development centers (FFRDCs) is substantially higher in Illinois than in peer states.

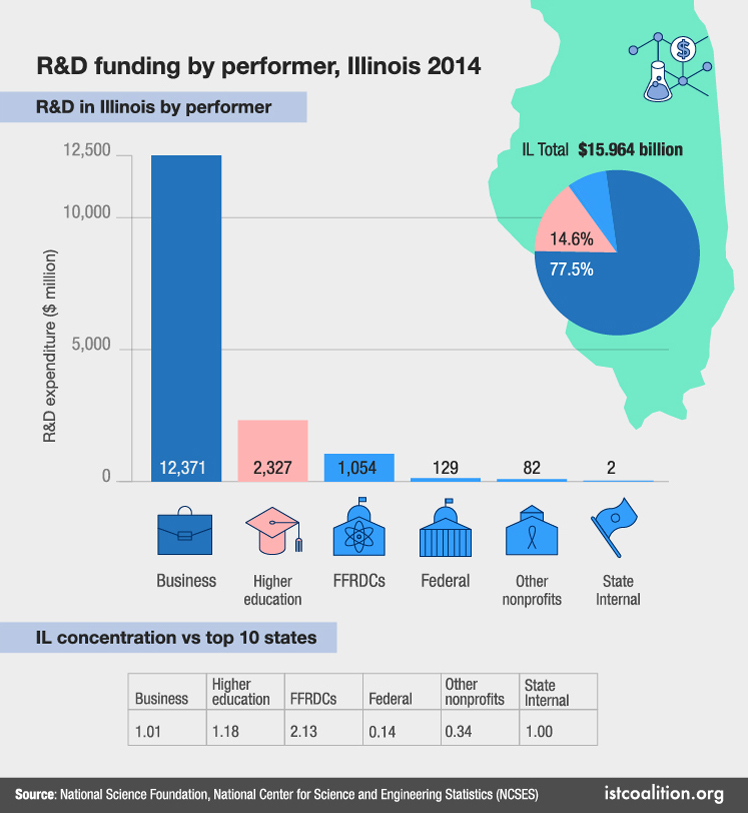

Academic R&D gaining momentum

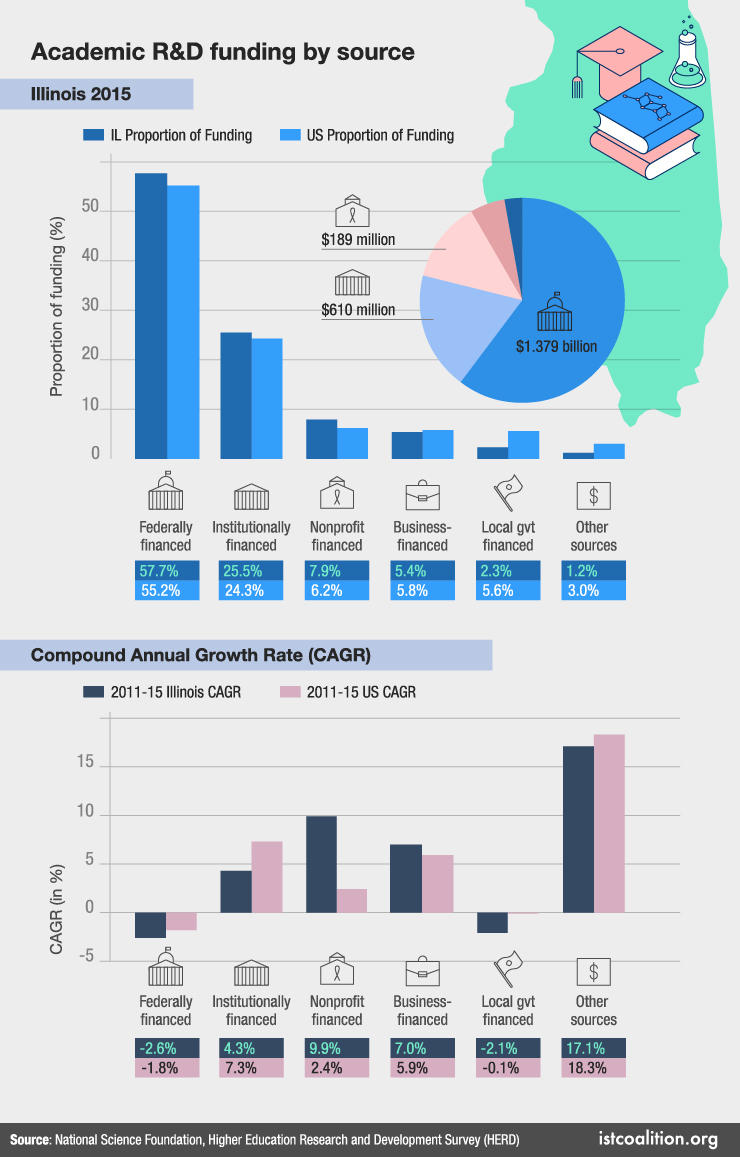

Illinois is a national leader in academic research, ranking eighth in academic R&D expenditures among all states. Academic R&D in Illinois reached a high point in 2013, thanks in large part to the National Center for Supercomputing Applications’ (NCSA) Blue Waters supercomputing project at the University of Illinois at Urbana-Champaign. Overall, R&D in the state grew at an annual rate of 0.4 percent from 2011 to 2015, slower than the national growth of 1.3 percent during that period. However, academic R&D in Illinois appears to be gaining momentum, growing by 2.6 percent from 2014 to 2015 compared with 2.2 percent growth nationally.

Both nationally and in Illinois, a majority of academic R&D funding comes from the federal agencies. However, Illinois’ academic institutions rely more heavily on federal funding than the nation as a whole. Compared with the national average, academic institutions in Illinois also receive a greater portion of their R&D funding from their own institutional funds and nonprofit organizations. In fact, in recent years in Illinois, the share of funding coming from nonprofits has grown substantially, with annual growth of nearly 10 percent compared with just 2.4 percent annual growth nationally. Funding from nonprofits is primarily provided by private foundations, such as the Bill and Melinda Gates Foundation and the Ford Foundation, among many others. The share of funding provided by these foundations, which is typically awarded through competitive grants, shows the strength of academic research conducted in Illinois.

Compared with the national average, Illinois’ academic institutions receive a greater share of funding from several federal agencies. These agencies include the Department of Health and Human Services (HHS), the National Science Foundation (NSF), and the Department of Energy (DOE). Illinois’ strength in funding from the HHS reflects the strength of health-related research in the state, which includes the Illinois Medical District and leading research hospitals, such as Northwestern University, Rush University, the University of Chicago, and the University of Illinois. Illinois’ strength in NSF funding is thanks in large part to extensive scientific research happening at the University of Illinois at Urbana-Champaign, which is the top university recipient of NSF funding nationwide, as well as at the University of Chicago and Northwestern University. The state’s strength in DOE funding can be largely attributed to the two DOE-run national labs, Fermilab and Argonne, which have strong research connections to the state’s universities.

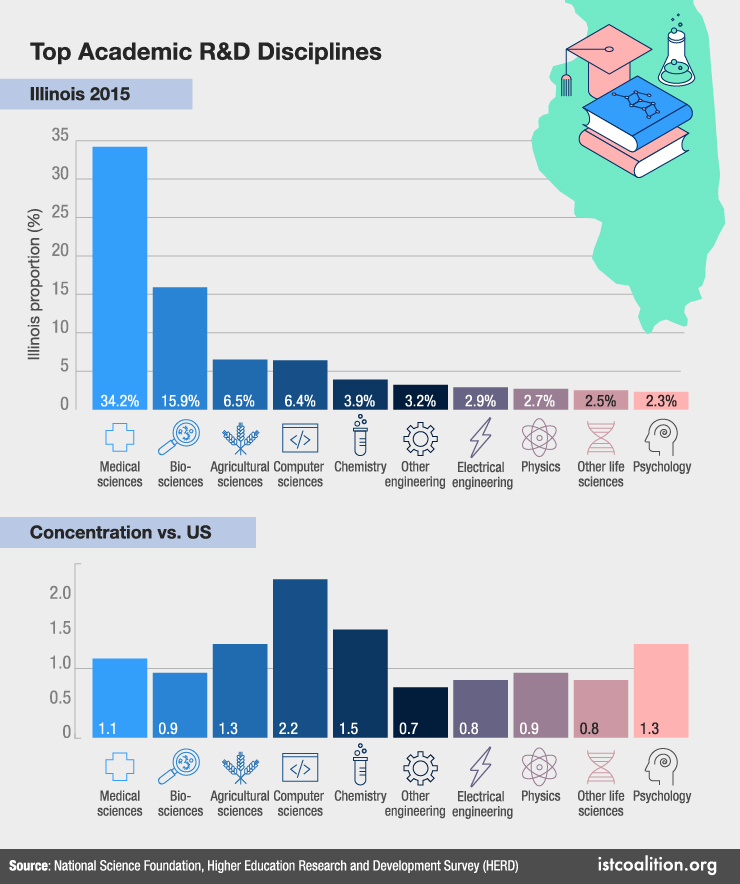

The top academic disciplines for research in Illinois include several that align well with Illinois’ business R&D strengths, including medical sciences, agriculture, and chemistry. Areas of academic research strength also include computer science, in which Illinois’ concentration of research is more than double the national average. This finding is consistent with the state’s production of computer science talent, where Illinois is a national leader.

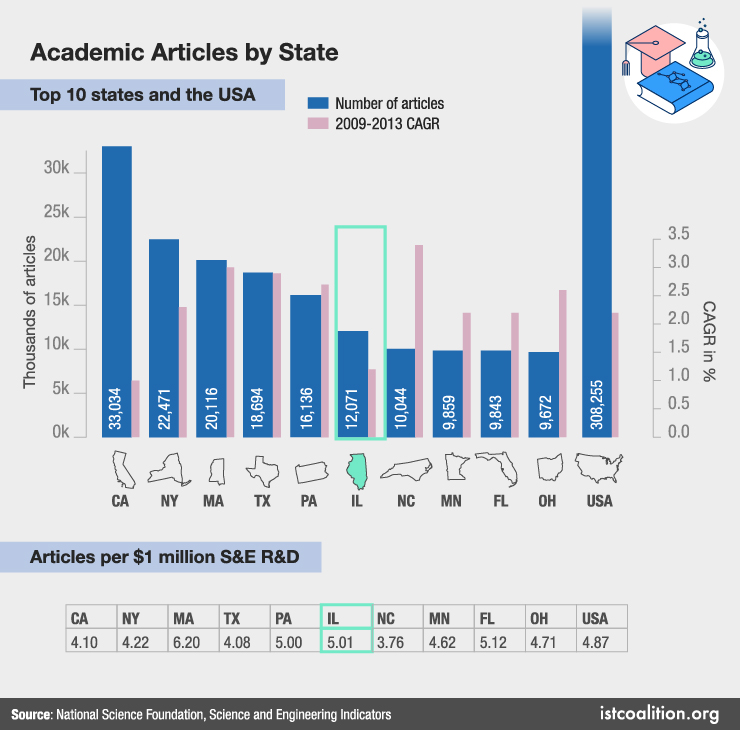

Academic articles

In contrast to expenditures, which represent inputs in the R&D process, academic articles are a measure of the innovation output from R&D. Illinois ranks sixth nationally in science, engineering, and health (SHE) academic-article output. Article output is growing at an annual rate of 1.2 percent in Illinois compared with annual growth of 2.2 percent nationally. Despite this slower growth, article output per $1 million in science and engineering R&D spending remains high in Illinois—5.01 articles are published in Illinois compared with 4.87 articles nationally—showing that research spending in the state yields a higher rate of return.

SPOTLIGHT: NCSA Blue Waters supercomputer

Housed at the National Center for Supercomputing Applications (NCSA) at the University of Illinois at Urbana-Champaign, the Blue Waters supercomputer is the country’s fastest open-science, sustained-performance supercomputer.[6] The Blue Waters project began in 2007, when the NSF awarded $208 million to NCSA for the development of a new petascale supercomputing project. To support the effort, the State of Illinois also contributed $60 million for the construction of facilities to house the supercomputer. This funding, along with institutional funds from the University of Illinois and private donations, helped bring the computer online in March 2013.

Since Blue Waters came online, scientists and researchers have used its computing power in a range of fields, from creating high-resolution geospatial imaging of arctic sea ice to combating gerrymandering. In addition to Blue Waters’ immense contribution to science, the project has also had a profoundly positive economic impact on the state. Projections show that by 2019, Blue Waters will have contributed $1.08 billion to the Illinois economy, including nearly 5,800 jobs.[7] This impact represents tremendous ROI for the state’s $60 million investment.

Federal labs remain a strength for Illinois’ R&D landscape

Illinois is one of only seven states with multiple FFRDCs[8], which include the U.S. Department of Energy’s Argonne National Laboratory and Fermi National Accelerator Laboratory (Fermilab). Together these labs contribute more than $1 billion to Illinois’ R&D landscape annually; provide thousands of quality STEM jobs; and conduct groundbreaking research in energy, security, the environment, and many other fields. Funding for federal labs nationally remained somewhat stagnant from 2011 to 2015, falling by 0.3 percent annually. Over the same period, funding for Argonne has grown 0.3 percent annually while funding for Fermilab has fallen 6.6 percent annually. Both Argonne and Fermilab receive the vast majority of their funding from the federal government. However, compared with FFRDCs nationally, Argonne receives a greater share of funding from the business sector.

Argonne and Fermilab’s connections to the business sector extend to several of their key initiatives, including user facilities maintained by both labs. These user facilities give industry and academic researchers access to advanced-research facilities that would otherwise be too expensive for a single company or university to maintain. User facilities include Argonne’s Advanced Photon Source (APS), the Argonne Leadership Computing Facility (ALCF), and Fermilab’s Illinois Accelerator Research Center (IARC), which aim to create research partnerships with industry. Beyond user facilities, the Joint Center for Energy Storage Research (JCESR) at Argonne also provides a unique connection to industry. JCESR was created to accelerate the development of innovative energy storage, bringing together 10 universities, five national laboratories, and five industry partners. Since its founding in 2012, JCESR has led to 55 invention disclosures, 30 patent applications, and more than 250 publications. Through these initiatives and many more, Illinois’ federal labs provide state-of-the-art resources to Illinois’ universities and industry community.

SPOTLIGHT: National Center for Agricultural Utilization Research

Located in Peoria, Illinois, the National Center for Agricultural Utilization Research (NCAUR) is the largest of four regional research centers run by the U.S. Department of Agriculture’s (USDA) Agricultural Research Service. The 270,000-square-foot facility is home to more than 200 researchers working to invent new uses of agricultural commodities for industrial and food products, develop new technologies to improve environmental quality, and support federal regulatory work. Despite the critical role of NCAUR’s research, President Trump’s proposed 2018 budget would close NCAUR and cut the USDA’s overall budget by more than 20 percent. This proposed cut and closure of NCAUR would be a significant setback for agricultural R&D in Illinois.

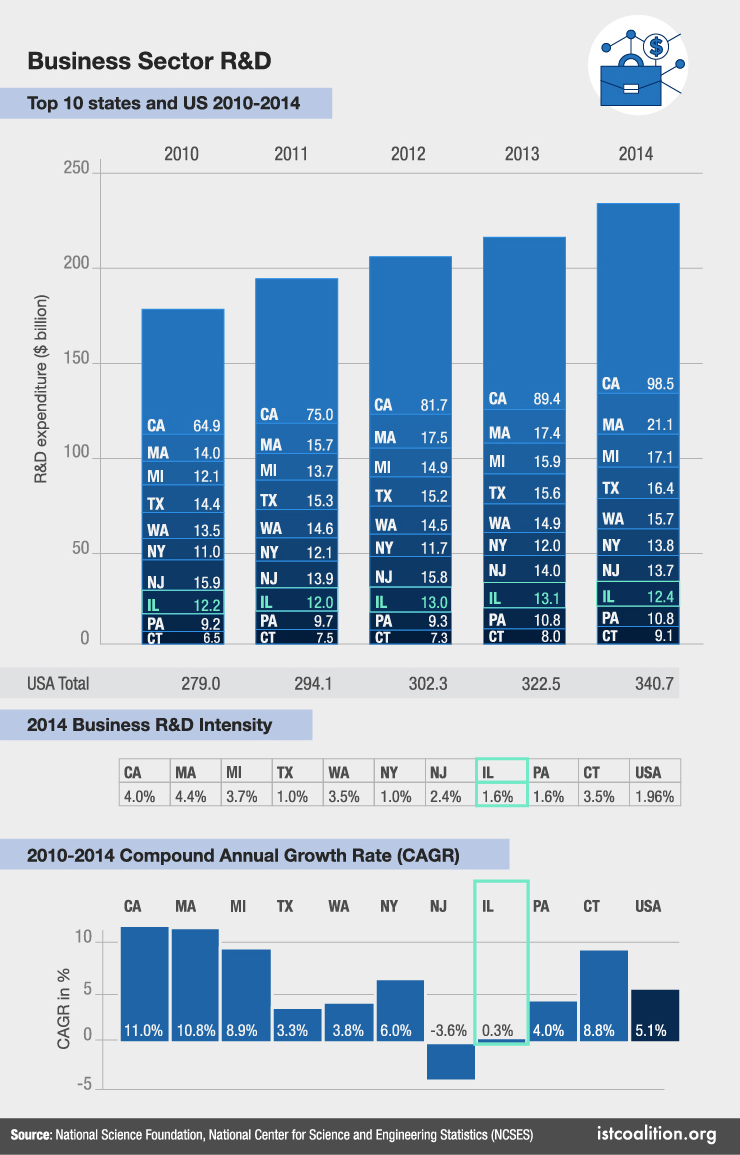

Business R&D shows slow growth in Illinois

Illinois’ business R&D landscape is one of the largest in the country, ranking eighth nationally and with expenditures of nearly $12.4 billion annually. Despite the high ranking for the state’s business R&D activity, the intensity of Illinois’ R&D activity—R&D expenditures relative to the state’s GDP—falls below the national average (1.6 percent compared with 2.0 percent, respectively). From 2010 to 2014, business R&D activity in the state remained relatively flat, with annual growth of just 0.3 percent compared with 5.1 percent growth nationally. Although the volume of business R&D in Illinois is still sizeable, the state has struggled to compete with many peer states.

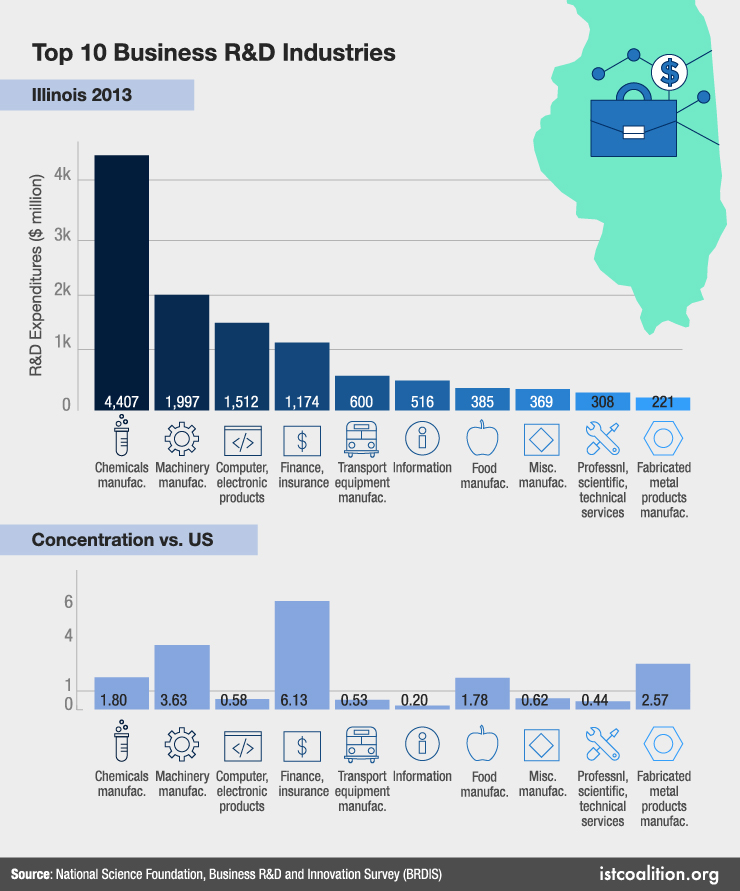

Perhaps unsurprisingly, Illinois’ business R&D strengths align with many of the state’s leading industries. Industries with a significantly higher R&D concentration in Illinois than nationally include chemicals manufacturing, machinery, finance and insurance, and food manufacturing. R&D in chemicals manufacturing is driven by Illinois’ robust pharmaceutical industry, which includes industry leaders like Abbott, AbbVie, Baxter, and Takeda, as well as growing companies like Lundbeck and Horizon. Illinois’ strength in machinery can largely be attributed to Caterpillar and John Deere—both leaders of industry in the state. Similarly, industry leaders Allstate and State Farm drive Illinois’ strength in insurance, while companies like Archer Daniels Midland, ConAgra Foods, and Kraft Heinz boost the state’s R&D activity in food manufacturing.

SPOTLIGHT: Collaborative R&D initiatives advancing health innovation in Illinois

Thanks to the strength of heath-related academic research and the strong presence of the pharmaceutical and healthcare industry in the state, Illinois is a national leader health-related R&D. This strength is amplified by initiatives that bring together researchers from across organizations and industries to share knowledge and conduct collaborative research. This section highlights just a few of these initiatives.

Chicago Area Patient-Centered Outcomes Research Network

The Chicago Area Patient-Centered Outcomes Research Network (CAPriCORN) is an unprecedented data-sharing effort among members of the Chicago medical community to support research, innovation, and improved patient outcomes. CAPriCORN began in 2014 with funding from the Patient-Centered Outcomes Research Institute (PCORI), a nongovernmental institute created by the Affordable Care Act to investigate treatment effectiveness nationally. Currently led by one of the region’s largest philanthropic organizations, The Chicago Community Trust, the CAPriCORN network consists of researchers, patients, health professionals, and community members from the Chicago area’s largest hospital systems. These partners include leading research hospitals like AllianceChicago, the Ann & Robert H. Lurie Children’s Hospital of Chicago, Cook County Health and Hospitals System, the Edward Hines Jr. VA Hospital, the Jesse Brown VA Medical Center, Loyola University, NorthShore University Health System, Northwestern University, Rush University, the University of Chicago, and the University of Illinois at Chicago. The network advances research with a centralized community, including a patient advisory board and a single institutional review board (IRB), streamlining research initiatives within the partner network.

Chicago Biomedical Consortium

Launched in 2006 with a $5 million grant from the Searle Funds at The Chicago Community Trust (SFCCT), the Chicago Biomedical Consortium (CBC) stimulates collaboration among biomedical scientists at Northwestern University, the University of Chicago, the University of Illinois at Chicago, and others. The consortium bridges institutional boundaries and enables interdisciplinary research, while also promoting the biomedical ecosystem in Chicago and developing successful entrepreneurs. To date, $50 million has been invested in biomedical research through the CBC, leading to more than 1,500 peer-reviewed publications, the establishment of six national centers at CBC universities, more than $500 million in follow-on funding, and $1.8 billion in total economic input for the Chicago area.[9]

Genomic Data Commons

The National Cancer Institute’s Genomic Data Commons (GDC) is an unprecedented data-sharing platform for cancer research launched at the University of Chicago in June of 2016. The GDC is one of the largest open-access cancer data repositories in the world, giving researchers seamless access to 4.1 petabytes of data on more 14,000 cancer patients. The wealth of data gathered and managed by the GDC streamlines the research process by allowing cancer researchers to analyze genes and evaluate treatments without the added hurdle of managing their own datasets. Since its launch a year ago, the GDC has grown to around 1,500 daily users and plans to double in size by 2018. The GDC’s early success and plans for future growth highlight the critical role that open-access data plays in the fight against cancer.

Illinois’ pharmaceutical industry partners with in-state universities

The pharmaceutical industry’s R&D concentration in Illinois is nearly twice the national average. This presence, along with Illinois’ strength in academic research in chemistry and medical science, has resulted in opportunities for research collaboration between industry and in-state universities. In 2016, AbbVie began funding five-year projects with both Northwestern University and the University of Chicago to research new cancer treatments. Takeda also announced a three-year commitment to the University of Chicago to fund research on inflammatory bowel disease in 2016. Abbott Laboratories also enjoys a relationship with the University of Illinois at Urbana-Champaign, including a satellite R&D facility at the university’s Research Park.

The creation of these research partnerships comes at a key time for both the pharmaceutical industry and academic researchers in Illinois. The cost of bringing a new drug to market now exceeds $2.5 billion, a figure that has increased by 8.5 percent annually since 2003.[10] By collaborating with university researchers, pharmaceutical companies open new paths to market through licensing agreements for any new treatments that might result from university partnerships. For university researchers, partnering with the pharmaceutical industry provides vital funding and resources at a time when science funding is under scrutiny—President Trump’s proposed 2018 budget would cut $5.8 billion from the NIH.[11]

Rosalind Franklin University Innovation and Research Park

Rosalind Franklin University of Medicine and Science (RFU) is a growing hub for basic science and translational research in Illinois. Federal research funding has grown by 80 percent since 2008 and includes funding for research in several critical areas, from Alzheimer’s and Parkinson’s diseases to cancer, behavioral disorders, and neurodegenerative diseases. RFU is located in Lake County, which boasts the highest concentration of pharmaceutical, diagnostics and medical device companies in the Midwest, including headquarters for industry giants like Abbott Labs, AbbVie, and Baxter, as well as operations facilities for Horizon Pharma, Lundbeck, Pfizer, and Takeda. To continue its research growth, promote innovation, and further partnerships with industry, RFU will break ground on its new Innovation and Research Park in 2017. The 100,000-square-foot expansion will include research labs, advanced facilities open to industry, and space for entrepreneurs. RFU is also partnering with Lake County-based SmartHealth Activator to facilitate the founding of biotech startups by university research faculty. All told, the Innovation and Research Park is expected to create around 500 new jobs for Lake County, with an economic impact of $117 million annually.[12]

Patent growth on par with the nation

Patents are a tangible outcome of R&D, representing the creation of an innovation. Illinois ranks seventh nationally for patent activity, with more than 5,000 utility patents—those covering new or improved products, processes, or machines—issued per year.[13] Patent growth in Illinois is on par with growth nationally, with annual growth of around 7.2 percent for both. Patents issued per year have nearly doubled in Illinois since the height of the Great Recession in 2008. Illinois’ patent creation relative to spending is also on par with the national average—each year the state produces 320 patents per $1 billion in R&D spending. In addition, several of the largest corporate US patent holders are headquartered in Illinois, including Boeing, Caterpillar, Deere & Company, Illinois Tool Works, and Motorola Solutions.[14]

SPOTLIGHT: Caterpillar’s partnerships drive R&D and innovation

With nearly $2 billion spent on R&D in 2016, Caterpillar is one of the key engines of Illinois’ business R&D community.[15] To further its R&D efforts and build its talent pipeline, the company has continuously tapped into all corners of the state’s innovation ecosystem. For instance, Caterpillar has partnered with the University of Illinois at Urbana-Champaign’s Research Park since 1999, incorporating the university’s expertise in computer science and engineering into its R&D process to assist with virtual product development, advanced simulation and design solutions. In 2015, Caterpillar furthered its partnership with the university by opening the company’s first data-innovation lab at the Research Park, which focuses on emerging data technologies and advanced analytics. Caterpillar is also partnering with the University of Illinois at Chicago’s Innovation Center, hiring students to tackle the company’s digital and analytics innovation challenges from a fresh perspective.

Caterpillar has also built strong ties to emerging companies in Illinois. In 2015, the company participated in the Illinois Science & Technology Coalition’s Corporate-Startup Challenge, connecting the company with emerging startups to boost new innovation partnerships. The same year, Caterpillar launched Caterpillar Ventures to invest between $500,000 and $5 million in early-stage companies. Caterpillar is also an investor in Uptake, the Chicago-based data analytics startup that’s now valued at more than $2 billion.[16] Beyond investing in early-stage data analytics companies, Caterpillar opened its own data analytics office in Chicago in late 2016, further expanding the company’s commitment to innovation.

SPOTLIGHT: Shared R&D spaces and new resources helping boost business innovation in Illinois

For many smaller companies, the up-front cost of R&D can be prohibitive, limiting their opportunity to enter the marketplace with an innovation. This reality is especially true for early-stage companies and small and midsized enterprises (SMEs) in advanced-technology industries or those companies developing new physical products. However, that dynamic is beginning to change thanks to the growth of shared-use R&D facilities that provide these companies with access to resources that would otherwise be unavailable. These facilities, therefore, make it easier for new technologies to enter the market. In Illinois, such facilities include mHUB, the 63,000-square-foot space focused on manufacturing and product development that opened in early 2017. mHUB provides early-stage companies and SMEs with access to coworking space, 10 fabrication labs for physical-product development, an onsite microfactory, and community support.

UI LABS is another organization helping to grow innovation in Illinois. Launched in 2014, UI LABS provides advanced R&D resources in the manufacturing space through its Digital Manufacturing and Design Innovation Institute (DMDII). It supports projects in product development, advanced manufacturing, supply-chain resilience, and cybersecurity in manufacturing. UI LABS also launched City Digital in 2015, which uses Chicago as a testbed for new urban infrastructure technologies. These infrastructure technologies are focused in four key areas: physical infrastructure, water, energy, and mobility. UI LABS also partners with Illinois universities to further its research and technology-commercialization goals. These universities include the Illinois Institute of Technology, Northern Illinois University, Northwestern University, the University of Illinois at Chicago, the University of Illinois at Urbana-Champaign, and Western Illinois University. Through its partnerships and platforms, UI LABS provides the business and academic communities with unique support, helping expand R&D in the state.

Illinois’ path forward

Illinois is a national leader in R&D, ranking in the top 10 in both academic and business R&D expenditures. The state’s academic R&D landscape is marked by strength in agriculture, chemistry, computer science, and medical sciences—each connecting directly to areas of business sector R&D strength. Illinois’ academic R&D is also notable because of the proportion of funding it receives from private foundations, which award funding through competitive grants. After a period of slow progress, the state’s academic R&D growth has accelerated, outpacing the nation from 2014 to 2015. In addition, Illinois’ two national labs boost the state’s R&D activity by around $1 billion annually, while also contributing resources to the academic and business R&D communities.

Business sector R&D in Illinois shows strength in pharmaceuticals, machinery, finance and insurance, as well as food manufacturing. This strength is a result of the state’s robust corporate community, which includes Fortune 500 companies like Abbott, AbbVie, Baxter, and Takeda in pharmaceuticals; Caterpillar and John Deere in machinery; Allstate and State Farm in insurance; and Archer Daniels Midland, ConAgra Foods, and Kraft Heinz in food. Helping to grow these areas of R&D strength in Illinois are partnerships among the business sector, universities, and national labs.

Despite its many strengths, Illinois’ R&D activity is not growing as quickly as many of its peer states. This slow growth comes at a time when the role of science and technology innovation in our nation’s economy is being called into question. President Trump’s 2018 budget proposal released in May would make drastic cuts to federal agencies that work to promote innovation. These agencies include the Economic Development Administration and the Small Business Administration, which have provided vital funding to Illinois initiatives like mHUB and the Smart Grid Cluster, as well as hundreds of early-stage companies, through Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) funding. Proposed cuts will also affect the DOE and the NSF, which provide substantial funding to Illinois universities and national labs. Given the large scale and long timeframe of R&D, such cuts would have a sizeable negative impact on innovation and economic development for decades to come.

Illinois’ two-year state budget impasse created an atmosphere of uncertainty that remains a hurdle for the state’s R&D community. For public universities, uncertainty exists around basic institutional funding for faculty and facilities, placing research efforts in jeopardy. Lack of stable state investment diminishes the ability of Illinois’ academic institutions to win funding from federal agencies and private foundations, which value state co-investment. For corporations, the budget impasse weakened incentives to conduct R&D in the state, including the R&D tax credit. Though the credit was reinstated in July of 2017, it has sunset four times in the last 14 years, creating uncertainty for businesses when planning their R&D outlook. For both public universities and the business community, strong and stable state support is essential for R&D growth.

No quick fix exists to reverse the trend for the Illinois R&D landscape, but there are steps that can be taken to move the state forward. The most pressing of these is to ensure stable, ongoing, funding to the state’s public universities. This stable funding will allow Illinois’ state universities to more effectively attract and retain faculty; invest in campus infrastructure, including research facilities; and improve the competitiveness of federal and nonprofit grant proposals. To support business-sector innovation, the state should make its R&D tax credit permanent. This credit has been shown to successfully promote R&D[17] and would put Illinois back on an even playing field with many peer states that offer a permanent credit. Key members of the R&D landscape in Illinois should look to expand their partnerships with other sectors, especially where areas of research strength overlap. Such arrangements include industry-university partnerships—such as Caterpillar’s partnership with the University of Illinois or AbbVie’s partnerships with Northwestern University and the University of Chicago. Others occur between industry and national labs, such as Argonne’s Joint Center for Energy Storage Research and Fermilab’s Illinois Accelerator Research Center. Taking these steps would boost innovation in Illinois by providing a solid foundation for R&D and fostering collaboration between areas of cross-sector strength.

R. Ortega-Argilés, L. Potters, and M. Vivarelli, “R&D and Productivity: Testing Sectoral Peculiarities Using Micro Data,” Empirical Economics, December, 2011.

Peer states in our analysis are other states in the top 10 for overall R&D expenditures.

Our analysis uses the latest R&D data available. For overall R&D and business R&D, the latest year of data available is 2014. For academic R&D, the latest year of data available is 2015.

R&D proportion in Illinois relative to other top 10 states. Concentration above one indicates above average R&D activity.

[6]

Utsav Gandhi, “UIUC’s Supercomputer Has a Projected $1B Impact On Illinois’ Economy,” Chicago Inno, 2017.

[7]

Dall’erba et al., “The impact of Blue Waters on the economy of Illinois,” University of Illinois, 2017.

[8]

Federally funded research & development centers

[9]

Accomplishments, Chicago Biomedical Consortium, updated September 16, 2016.

[10]

“Cost to develop and win marketing approval for a new drug is $2.6 billion,” Tufts Center for the Study of Drug Development, November, 2014.

Jocelyn Kaiser, “Lawmakers decry Trump plan to slash NIH 2018 budget,” Science, May, 2017.[12]

“Facts and Figures” Rosalind Franklin University Innovation and Research Park. July, 2017.[13]

United States Patent and Trademark Office, 2014[14]

Top 300 Organizations Granted U.S. Patents in 2016, Intellectual Property Owners Association, 2016.

Yuliha Chernova, “Revolution backs IoT startup Uptake at $2 billion valuation,” Wall Street Journal, February, 2017.

Archive

2022 - R&D Index

Illinois' R&D Landscape and How COVID-19 Impacted Innovation

2020- R&D Index

Illinois' Capacity for Innovation & Economic Growth

2019 - R&D Index

Illinois' R&D Landscape & Path Forward

2018 - R&D Index

R&D growth struggles to match peer states, but machinery, finance & insurance among bright spots.

2017 - R&D Index

New analysis finds slow R&D growth in Illinois, despite key academic and business areas of strength.

2015 - R&D Index

Analysis finds alignment between federal funding for academic science and technology R&D, research quality, and output in Illinois.

2014 - R&D Index

R&D expenditures by Illinois universities hold steady

2013 - R&D Index

Capital and infrastructure for innovation