By Mark Denzler, Vice President & COO, Illinois Manufacturers Association, Mark Harris, President & CEO, Illinois Science and Technology Coalition and Warren Ribley, President & CEO, Illinois Biotechnology Innovation Organization

Illinois’ research and development (R&D) tax credit expired in 2016 and has yet to be renewed. Why is that a big deal? R&D tax credits help boost private sector R&D spending, create jobs, and contribute to the health of the state economy. A majority of research on the return on investment of R&D tax credits shows they are an effective tool in promoting R&D spending by private industry. A 2016 study on tax incentives in the U.K. demonstrated a near doubling of R&D spending and 60% increase in patents following an expansion of the country’s R&D tax credit program. Similarly, research shows a 10% drop in the price of R&D generates a 26% increase in the volume of R&D.

To promote private spending on R&D, the Federal Government made its R&D tax credit program permanent in 2015. This step comes on the heels of nationwide growth in R&D over the past several years. Business R&D spending increased by nearly $40 billion in the U.S. from 2012 to 2014, with an additional increase of nearly $20 billion projected from 2014 to 2015. These increases bring the projected business R&D spending to $360 billion in 2015.

Illinois’ R&D credit was originally created in 1986. After a brief, four-month suspension in 2003, the credit was renewed and now must be renewed every five years. Unfortunately, the credit has sunset four times in the last thirteen years creating instability for innovators and businesses who are often planning ten and twenty years in the future. The expiration of Illinois’ tax credit in 2016 undermines the state’s ability to remain competitive and foster economic growth. As of 2013, Illinois ranked 7th in the nation with business R&D expenditures of $13.1 billion. Despite the state’s top-10 status, R&D is growing at a slower pace in Illinois than it is nationally. From 2010 to 2013, Illinois business R&D expenditure rose by 7.2%, lagging nationwide growth of 18.7% over that time period.

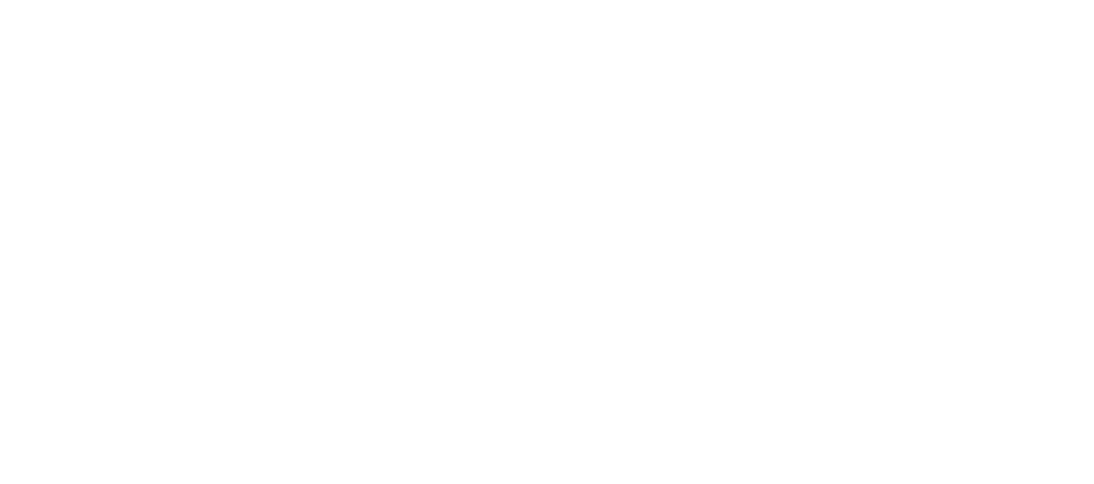

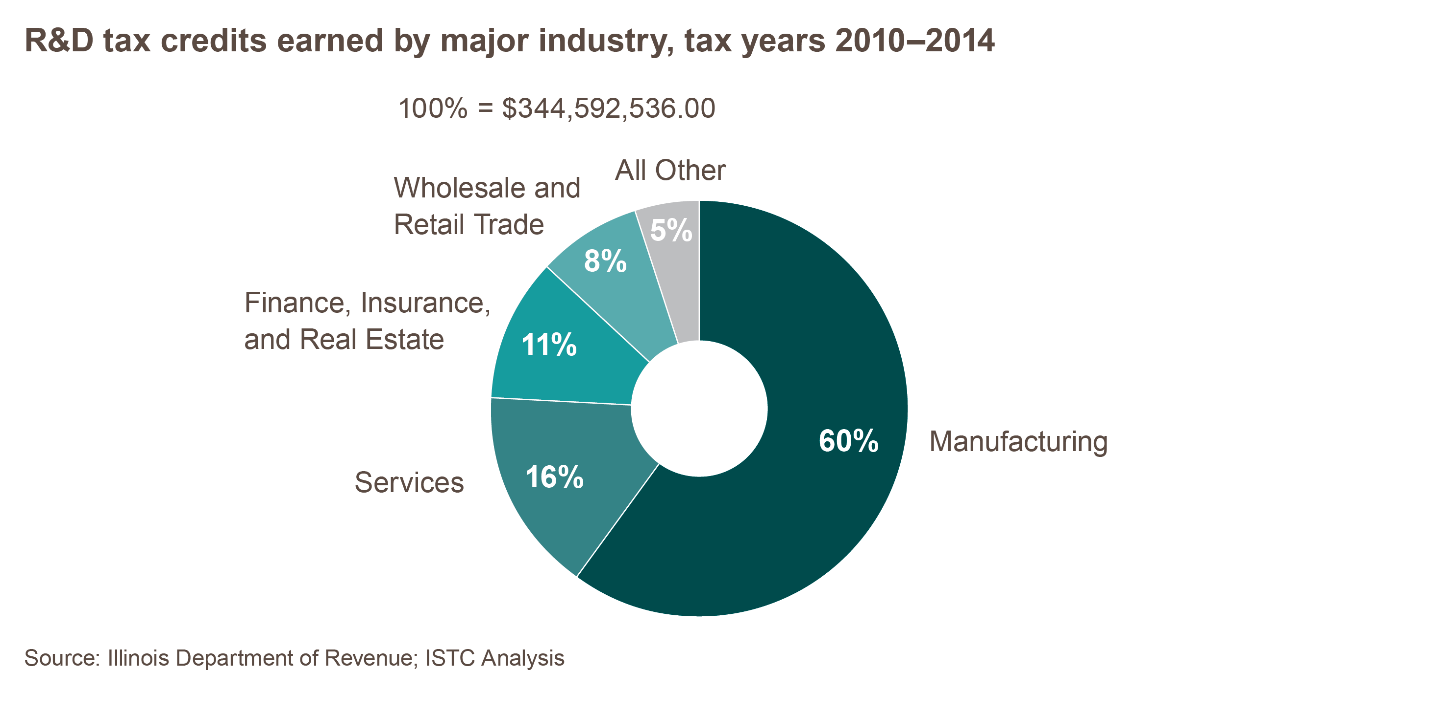

After the five-year extension of the Illinois R&D tax credit in 2011, the ISTC released findings on the importance of the credit to several industries, most notably the state’s manufacturers (note: manufacturing also includes the pharmaceutical industry). Updated data on the credit from the Illinois Department of Revenue continues to illustrate the importance of the credit to in-state manufacturing, which accounted for 60% of credits earned from 2010 to 2014. Data also reveals a sharp uptick in credits earned from 2010 to 2013, followed by a drop in 2014. This fluctuation is largely due to a spike in finance, insurance and real estate credits in 2012 and 2013. However, credits earned by the manufacturing industry remained fairly constant from 2010-2014.

In October, the Crain’s Chicago Business Editorial Board called for Illinois lawmakers to reinstate the R&D tax credit, citing steps that states like New York and California have taken to make their credits permanent. With the credit now expired, Illinois has become one of only a handful of states not to offer an R&D tax credit. Allowing the credit to lapse in Illinois negatively impacts the state’s ability to attract and retain innovative private sector businesses. In addition to a permanent extension of the credit, Illinois policymakers should modernize the credit by changing the base calculation to incent companies that may be conducting R&D, but not necessarily increasing it every year. Taking these steps would provide companies doing business in Illinois with the certainty needed to grow their R&D presence and make the state more competitive nationally.

Watch and Listen

Greg Baise and Mark Denzler: IL State Capital Blue Room

Learn

- Reinstate the R&D tax credit: a Crain’s Chicago editorial

- IMA President & CEO Greg Baise speaks at the City Club of Chicago

- My View: Biopharmaceutical innovation ecosystem requires greater support – Mark Denzler writes for the Rockford Register Star

- Daily Herald Business Ledger: Overlooked manufacturing tax credits

What we’re reading

- Illinois Science & Technology Coalition and Institute nominated for ChicagoInno’s 50 on Fire award

- 15 years of Chicago Innovation: Where the city stands today

- The new Polsky Center brings innovation at UChicago under one brand

- AARP and UI Research Park open 2,700-square-foot facility allowing collaboration on technology-based research

- Caterpillar opens first Chicago office in Merchandise Mart

- Built in Chicago’s top 100 digital companies in Chicago – 2016

- ISTC/I in the news: “High school students, State Farm partner for STEM projects”

- Illinois Science & Technology Institute celebrates 50 percent growth from 2015-16

Illinois Innovation Network Featured Content

Energy Foundry’s Startup Toolkit: Tools to quickly establish administrative foundation of your business.

Energy Foundry’s Startup Toolkit: Tools to quickly establish administrative foundation of your business.