By Mark Harris, President and CEO, Illinois Science and Technology Coalition (ISTC)

In 2011, the Illinois General Assembly and Governor Quinn approved a five-year extension of the state Research & Development tax credit through to 2016. The extension came at a critical time for R&D intensive businesses in the state. As the latest update of the Illinois Innovation Index shows, after a substantial contraction during the recession, industry outlays for R&D have rebounded since FY2010. The 2011 extension ensured innovative businesses are rewarded for initiating new R&D projects and enabled others to continue budgeting ahead for long-term R&D projects.

Illinois’ R&D tax credit is a non-refundable tax credit1 of 6.5% of qualifying research expenditures on in-house and contractual R&D performed in Illinois. As with all other states, Illinois’ tax credit uses the federal definition to determine qualifying research expenditures. Businesses calculate their credit based on their average expenditure on R&D for the latest three tax years.

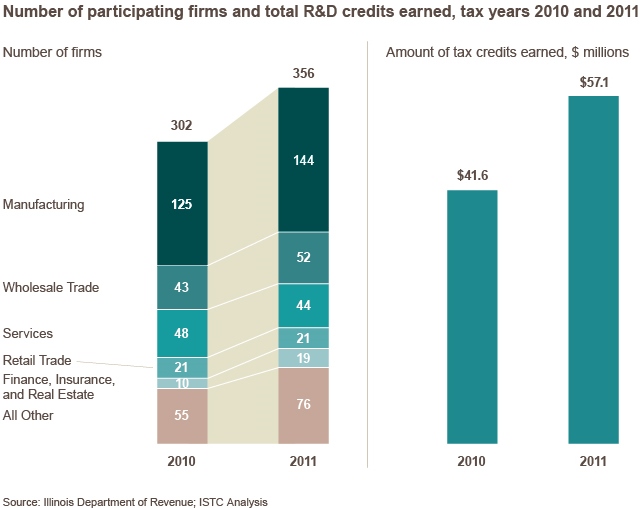

According to the latest available data, a growing number of manufacturers and small and mid-sized businesses are benefiting from the credit. In 2011, over 350 businesses earned state R&D tax credits, an increase of more than 50 compared to 2010. The majority of businesses earning tax credits are manufacturing businesses (see info graphic for additional data).

Elk Grove-based Acme Finishing Company, a provider of finishing services to various manufacturing industries, exemplifies how small businesses have made use of the state R&D tax credit. In response to cost reduction pressures from auto industry customers, Acme used the R&D tax credit to incorporate robotics into its operation. The resulting efficiencies enabled Acme to meet customer demands and improve overall throughput. According to Al Colella, Quality Assurance Manager, “[T]he Illinois tax credit has helped justify the above project and future projects that require research and development”.

The ability to invest into sustained competitiveness is a critical benefit of the state tax credit says Marc Blackman, President and CEO of Gold Eagle, an 81 year old small manufacturer based in Chicago. “[T]he State of Illinois has been a great partner with the offering of the R&D tax credit. Any kind of investment in business these days is not easy and often brings ROI uncertainty,” explains Blackman. “The R&D Tax Credit has helped to soften the blow while also incentivizing Gold Eagle to keep investing to improve our company.” Gold Eagle has to consistently invest in R&D to develop improved performance chemicals and protectants for the automotive and other industries.

The R&D tax credit is one effective way to support small and mid-size research and development, which plays a critical role in any innovation ecosystem. That is why the ISTC helped pass the R&D tax credit extension in 2011 and will continue to support additional measures and policies to incentivize research and development across Illinois’ ecosystem.

1. A nonrefundable credit means that the credit cannot be used to increase a tax refund or to create a tax refund when the taxpayer does not already have one.

Did You Know?

Increasingly small and mid-sized businesses are benefiting from the Illinois’ state R&D tax credit. Although the top 10 credit recipients still earn the bulk of all credits, between 2010 and 2011 the share of tax credits earned by the top 21-356 increased from 19 percent to 25 percent of all credits. In addition, over a third of this increase was attributed to the bottom 50-365 credit earners who earned 78 percent more credits in 2011 than in 2010.2 Manufacturers have traditionally been the main users of the R&D tax credit and the latest data conforms to this pattern. In both 2010 and 2011, approximately 40 percent of credit recipients were manufacturers. The share of credits earned by manufacturers, however, increased during this period to approximately two-thirds of all credits.

2. ISTC analysis of Illinois Department of Revenue data.

Learn:

- Eight myths that keep small businesses from claiming the R&D tax credit

- Do state incentives for innovation work? New study finds that they do

- Illinois Department of Revenue Regulations: Research and Development Credit

More News:

- Federally funded research at Illinois’ universities creates Chicago jobs

- The Science Coalition releases findings Companies Created from Federally Funded University Research, Fueling American Innovation and Economic Growth in Sparking Economic Growth 2.0

- Science Coalition, Illinois Fact Sheet

- Governor Quinn Announces $250,000 Nanotechnology Education Investment for Wheeling High School

- Universities and private groups opening tech hubs to breed next generation of startups

- Governor Pat Quinn, Shedd Announce Largest Solar Installation At Cultural Institution In Illinois

- University of Chicago to open business incubator to spur innovation

Illinois Innovation Network Featured Resource:

Each month, the Illinois Science and Technology Coalition features a service or resource available to innovators and entrepreneurs in the state of Illinois on the Illinois Innovation Network. To learn more and add your resource to the Network, click here.

Illinois Medical District Economic Impact Report

Illinois Medical District Economic Impact Report

The Illinois Medical District is a special-use zoning district located just west of downtown Chicago. According to the results of an economic impact study released by the IMD Commission (IMDC), the District adds $3.4 billion to the Chicago region’s economy, is responsible for more than 18,000 jobs that otherwise would not exist, and contributes more than $75 million to the tax revenue of the state and nine-county Illinois portion of the Chicago Metropolitan Statistical Area. Continue reading at the Illinois Inovation Network![]()