By Rumi Morales, Executive Director, CME

According to a recent report by Accenture, global investment in financial technology (fintech) companies grew by 200% from 2013 to 2014 to $12 billion, compared to 63% overall venture capital growth. Expectations are for this rapid ascent to continue through 2015, especially in booming areas like digital currency technology and crowdfunding.

For the state of Illinois, innovation in the financial industry has historically been the norm. The first IPO, the first federal grant for infrastructure, the first bank to establish a pension plan, the first US futures exchange, and so many more were established here. Increasingly, however, fintech startups are choosing cities like New York, San Francisco or London as their base because of the existing talent pool, a more established VC community and better access to fintech incubators and accelerators.

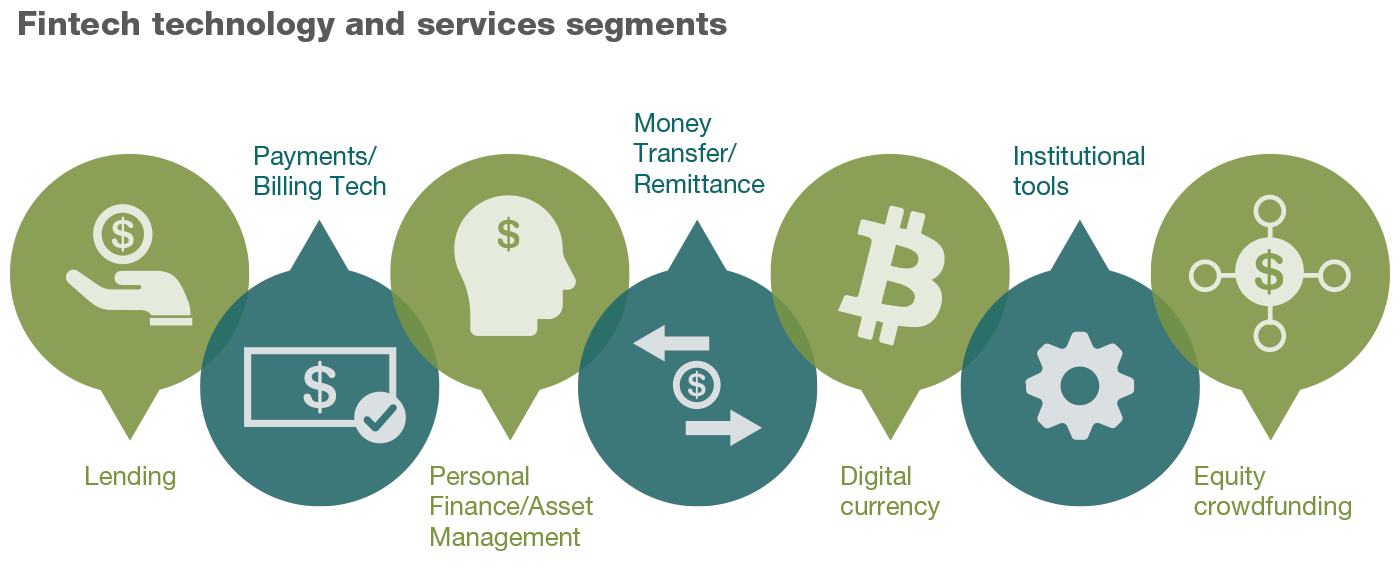

As the financial services industry continues to be impacted by technology, fintech companies will become increasingly important, driving more capital and talent to where those companies reside. The fintech sector can include anything from big data analytics and predictive modeling, to payments, risk management, security and crowdfunding. The spectrum of opportunities to innovate new products, services and processes is growing.

Chicago’s Avant and Braintree exemplify the increasing appetite among investors for fresh innovations in finance and the potential for fintech here in Illinois. Braintree was acquired for $800 million by Ebay, while Avant, an online lender offering credit lines to borrowers just below prime at higher interest rates, has raised $1.4 billion to date.

To ensure Illinois can capitalize on the fintech boom and its legacy of financial innovation, numerous local institutions across the public and private sector are starting to respond by harnessing the abundance of financial talent and companies residing in the state. Earlier this year, ChicagoNEXT, which brings together small and large corporations alike to help drive growth and opportunity locally, launched a fourth vertical focused on fintech innovation. Non-profit organizations like FinTEx – which grew originally from a grassroots effort to build a fintech cluster in Chicago – continue to expand their membership. As the fintech ecosystem expands, FinTex will serve as an intermediary between companies and various fintech industries across the state.

Illinois academic institutions are also developing innovation centers and tech research centers, and working more closely with corporations and entrepreneurs to develop tangible solutions to enhance opportunities for the fintech space. Examples of this include the Chicago Innovation Exchange (CIE) at the University of Chicago, Kellogg School of Management Innovation and Entrepreneurship Initiative at Northwestern, and the Computer Science Department and Tech Research Park at University of Illinois Urbana-Champaign.

Here at CME Group, we’ve launched a number of initiatives in the past 18 months to continue the company’s legacy of innovation. CME Ventures, the company’s venture capital initiative, makes investments in early stage technology companies which may have a future impact on the financial industry. Additionally, the company launched an innovation lab, which seeks to foster new growth opportunities from within, to eventually bring new products and services to the marketplace.

These efforts need to continue and should expand throughout Illinois for the state to re-capture its lead as an innovator in finance, and to grow jobs and opportunities for the future. Given the state’s historical legacy, financial infrastructure, enviable geographic position and Fortune 500 companies, the opportunity for fintech companies to thrive holds great promise.

* For more information refer to the CB Insights Periodic Table of Fintech.

Watch and Listen

Fintech Exchange 2015: A Chicago story

Learn

News

- Motorola Mobility to take over Lenovo’s mobile business

- Southern Illinois University School of Medicine opens new hypertension clinic

- Argonne scientists develop cheaper fuel cell catalyst

- University of Illinois at Urbana-Champaign ranked 4th best engineering school in the world

- Inc. Magazine profiles Chicago’s booming tech scene

Illinois Innovation Network Featured Resource:

Illinois Innovation Network Featured Resource: Each month, the Illinois Science and Technology Coalition features a service or resource available to innovators and entrepreneurs in the state of Illinois on the Illinois Innovation Network. To learn more and add your resource to the Network, click here.

The mission of the Women’s Business Development Center is to provide services and programs that support and accelerate women’s business ownership and strengthen their impact on the economy. On Wednesday, September 2nd, WBCD will host the 29th Annual Entrepreneurial Woman’s Conference

The mission of the Women’s Business Development Center is to provide services and programs that support and accelerate women’s business ownership and strengthen their impact on the economy. On Wednesday, September 2nd, WBCD will host the 29th Annual Entrepreneurial Woman’s Conference